Why these suburbs stand out in 2025

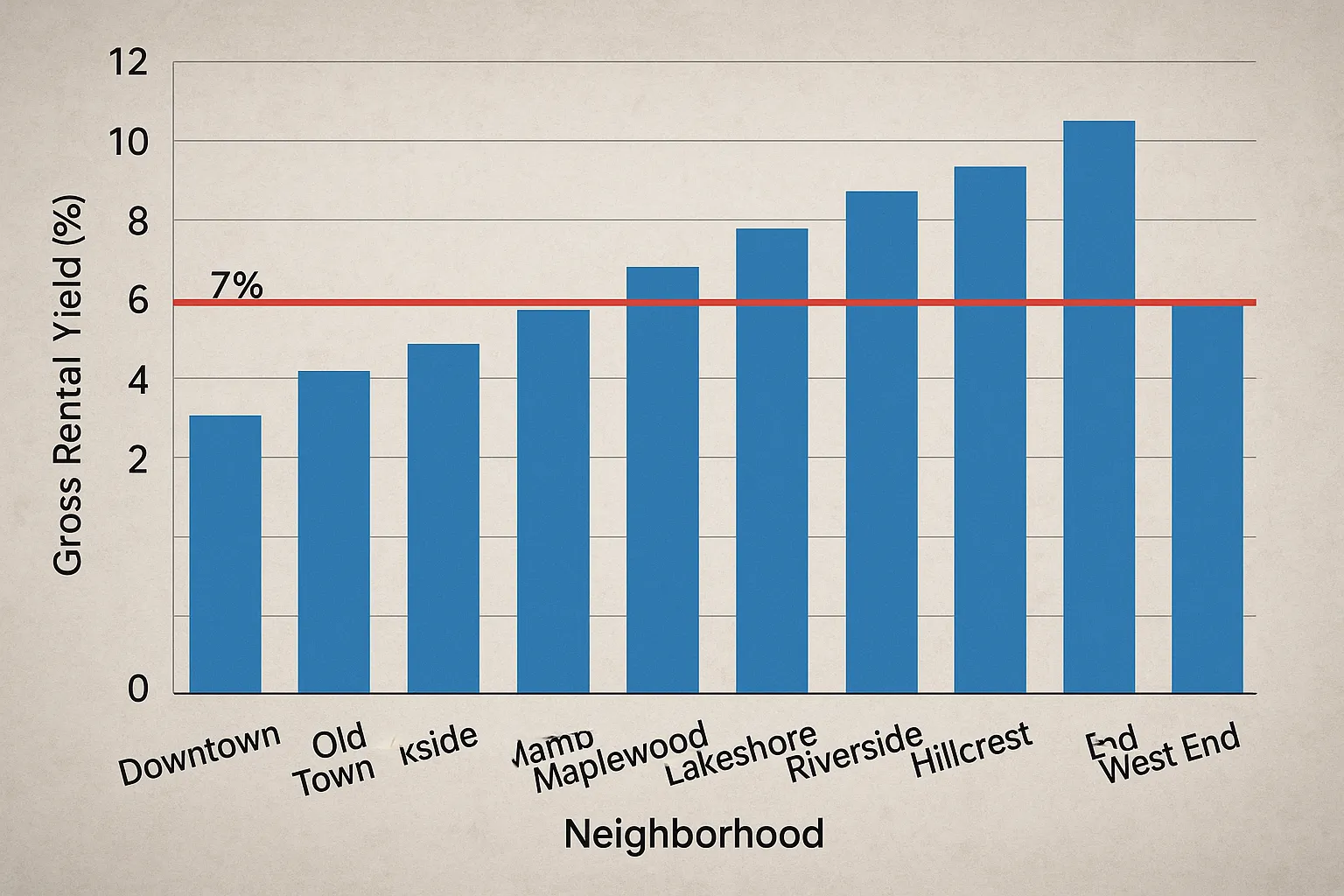

For the fourth year running, Dubai has ranked among the world’s top three cities for gross rental yields, according to data from Property Monitor and JLL. The city-wide average sits at a healthy 6 percent, yet a handful of high-growth neighbourhoods consistently return 7 percent or more – even after deducting service charges.

For Australian investors facing a cooling domestic market and a still-restrictive negative gearing environment, that 1 percent uplift can mean thousands of dollars in additional passive income each year, while also providing a natural currency hedge against the AUD.

Below we unpack eight Dubai postcodes that tick the three boxes most Aussie buyers care about:

- Net yields of at least 7 percent in 2024–25.

- Strong 3-year capital appreciation potential driven by infrastructure or population growth.

- Availability of freehold title for foreign owners.

All price and yield figures are sourced from Dubai Land Department (DLD) transfers, Asteco Q1 2025 market reports, and average service-charge data collected by Dubai Invest’s research team.** Yields refer to long-term (one-year) leases, not holiday homes.

1. Jumeirah Village Circle (JVC)

- Typical gross yield: 7.5 – 8.2 percent

- Average price: AED 1,050 per sq ft (A$4400) for new-build one-bed units

- Vacancy rate: 4 percent

What started as a budget community on the city’s edge is now one of Dubai’s busiest construction zones. Australians like it for the Goldilocks mix of affordable studio and 1-bed layouts that are catnip to young expats working in Dubai Marina or the Internet City tech corridor.

Key growth drivers:

- Opening of the JVC Mall in late-2025 with a Spinneys flagship and cinema.

- RTA’s Hessa Street upgrade, slashing drive times to Sheikh Zayed Road.

- Abundant off-plan launches from Ellington and Sobha keeping inventory fresh and energy-efficient.

Investor takeaway

Opt for buildings with service charges under AED 14 per sq ft to keep your net yield above 7 percent. If you plan a two-bed, insist on a corner unit as dual-aspect windows rent up to 8 percent faster.

2. Dubai Silicon Oasis (DSO)

- Typical gross yield: 7.4 percent

- Average price: AED 900 per sq ft

- Tenant profile: Engineers, fintech staff, start-ups in Dubai Digital Park

DSO was the first free-zone community to integrate residential and commercial plots. The latest phase, Digital Park, has added 150,000 m² of Grade-A office space since 2023, creating a self-contained tech hub analogous to Sydney’s Macquarie Park.

Why yields hold up:

- Limited new residential releases keeping supply tight.

- Family-friendly townhouses competing directly with pricey Mirdif villas.

- Government-subsidised tuition at two new international schools driving long-lease demand.

Investor takeaway

Studios see higher nominal yields (8 percent) but two-bed apartments enjoy lower churn, saving on agency fees. Factor in service charges of roughly AED 12 per sq ft.

3. International City – Phase 2 (Warsan Village)

- Typical gross yield: 8 percent+ on townhouses

- Average price: AED 780 per sq ft

- Vacancy rate: sub-3 percent

Often misunderstood as purely low-cost housing, Warsan Village – the freehold townhouse enclave inside International City – tells a different story. Three-bed homes rent for AED 115,000 a year, barely 20 minutes from Downtown via Ras Al Khor Road.

Growth signals:

- The long-awaited Dragon Mart Metro stop has received budget approval for 2026.

- Dubai Municipality’s 100-hectare Lagoon & Safari extension will push land values north.

- A new Australian-curriculum school broke ground in Q1 2025, perfect for expat families.

Investor takeaway

Most townhouses trade below AED 2.1 million, just under the golden AED 2 million property-visa threshold. That means two adjoining units can secure residency for two family members – a strategy many Aussies deploy for tax residency planning.

4. Dubai Sports City (DSC)

- Typical gross yield: 7.2 percent

- Average price: AED 880 per sq ft

- Tenant profile: PE teachers, fitness trainers, young couples

Forget the half-finished stadium headlines of a decade ago. DSC has matured into an affordable, pet-friendly alternative to Motor City, boosted by the handover of 15 new towers since 2022.

What’s pushing rents:

- Expansions to Victory Heights Primary and Bradenton Prep Academy pulling family demand.

- Etihad Rail’s upcoming Al Maktoum-to-Dubai Central passenger line (target 2027) passes 3 km west of the community.

- Low service charges (AED 9–11 per sq ft) let landlords keep pricing competitive.

Investor takeaway

One-beds in elite sports-themed buildings (Elite 1–10) with golf-course views command up to a 10 percent rent premium. Ensure your property manager knows how to capture that value in lease renewals.

5. Arjan

- Typical gross yield: 7.6 percent

- Average price: AED 950 per sq ft

- Vacancy rate: 5 percent

Located directly opposite Dubai Hills, Arjan is sandwiched between two mega malls (Dubai Hills Mall and Mall of the Emirates) yet still trades at a 30 percent discount to both. The newly opened Mediclinic Parkview Hospital has accelerated occupancies among healthcare staff.

Other catalysts:

- The Miracle Garden tourist season (November–April) creates a steady pipeline for short-let conversions.

- Dubai Municipality’s revised masterplan adds two metro stations on the Purple Line by 2028.

- High-spec boutique developments from Vincitore and Samana appeal to design-conscious tenants.

Investor takeaway

Buyers can still find off-plan payment plans stretched to 2029. Locking today’s price with 60-40 post-handover terms magnifies internal rates of return if you intend to refinance later in Aussie dollars.

6. Al Furjan

- Typical gross yield: 7 percent on apartments, 6.5 percent on villas

- Average price: AED 1,050 per sq ft (apartments)

- Tenant profile: Jebel Ali Free Zone and Expo City workforce

The 2022 opening of the Route 2020 Metro extension turned what was once a car-centric villa suburb into a bona fide transit-oriented community. Five years on, the rental upside has not yet peaked as Expo City’s commercial district continues rollout.

Why it matters:

- The new Gemz and Pearlz by Danube towers leasing up at record speed.

- Two British-curriculum schools within walking distance of the metro.

- Retail vacancy dropped from 15 percent to 6 percent in 18 months, boosting liveability.

Investor takeaway

Studio units near Al Furjan Metro Station A see near 0 percent summer vacancy. Pair that with Danube’s 1 percent monthly post-handover payment plan to keep gearing low.

7. Town Square Dubai

- Typical gross yield: 7.1 percent on apartments

- Average price: AED 820 per sq ft

- Vacancy rate: 3 percent (family units)

Nshama’s master-planned community 20 minutes south of Arabian Ranches has crossed 25,000 delivered homes. The ride-sharing boom means young families no longer mind the semi-suburban location, especially with 20 acres of parks and skate venues on their doorstep.

Upcoming boosts:

- Opening of the 2,600-student Town Square School in September 2025.

- Souk Extra retail centre doubling F&B outlets.

- Planned RTA on-demand electric bus loop connecting to Mall of the Emirates metro.

Investor takeaway

Service charges sit at a lean AED 10–11 per sq ft, and properties are still priced below the AED 1 million stamp duty trigger that applies in several Australian states – nice for investors juggling both markets.

8. Dubai South (Residential District)

- Typical gross yield: 7 percent

- Average price: AED 760 per sq ft (ready units)

- Tenant profile: Aviation, logistics and Expo City staff

Home to Al Maktoum International – set to become the world’s largest airport by 2030 – Dubai South is the long game. Yields are already healthy because supply remains deliberately phased, while the live-work Free Zone status attracts multinational staff seeking proximity to warehouses and cargo ramps.

Growth drivers:

- Etihad Rail’s Phase 2 freight line operational, with passenger service by 2026.

- 25 billion-dirham airport expansion funded in 2024.

- Expo Village converted into 14,000 rental apartments, reducing commute times for on-site employees.

Investor takeaway

Look for fully furnished studios delivered by MAG and The Pulse. They rent 15 percent faster than shell-and-core units and qualify for 10-day handover, speeding up your first rental cheque.

Crunching the numbers: Turning a headline yield into real cash flow

A 7.5 percent gross yield does not automatically equal 7.5 percent in your pocket. Australians must account for:

- Service charges: Typically AED 8–18 per sq ft depending on tower amenities.

- Property management fees: 5 percent of annual rent for full management (standard in Dubai).

- Vacancy allowance: Budget at least 2 weeks each year, even in high-demand precincts.

- Currency transfer costs: AUD to AED FX spreads average 0.6 percent with specialist brokers versus 4 percent at the Big Four banks.

After these deductions, the eight suburbs above still net 6.1 – 7 percent, comfortably beating Sydney’s median of 3.2 percent (CoreLogic, May 2025).

How to finance as an Australian expat or non-resident

- UAE mortgage: Up to 60 percent LTV for non-residents at ~5.25 percent variable. Approval in Principle letters can be secured in 48 hours with standard KYC.

- Equity release on Australian property: Tap redraw facilities where rates may be lower, then wire funds to Dubai via a low-cost FX platform.

- Developer post-handover payment plans: Typical 60/40 or 70/30 spread across 3-5 years. No bank fees, but you forego mortgage interest deductions if you become a UAE tax resident.

Tip: Pair a developer plan with a two-year corporate lease to lock income while your capital outlay is still staged.

Tax and regulatory checklist for Aussies

- Double Tax Agreement: Australia does not have a DTA with the UAE. Dubai rental income is tax-free locally but is technically assessable in Australia if you remain tax resident. Seek advice on foreign income offsets.

- Landlord insurance: Not common in Dubai; instead, insist on a 5-percent security deposit and annual AC servicing clause in the tenancy contract.

- Title registration: Mandatory DLD fee of 4 percent of purchase price, payable at transfer.

- Conveyancing timeline: Average 30 days from MoU to transfer for secondary properties; 7 days for off-plan assignments.

Frequently asked questions

Is short-term (Airbnb) letting legal in these communities?

Yes, provided you obtain a Holiday Home Permit from Dubai Tourism. Service charges are higher, and net yields vary. Most Australian investors start with long-term leases for predictable cash flow.

Can I get a 10-year Golden Visa with any of these properties?

Only if your individual investment is valued at AED 2 million or more and is mortgage-free. Two smaller properties cannot be aggregated for the Golden Visa.

Are yields likely to compress once new metro stations open?

History suggests capital values rise faster than rents directly after transit upgrades, pushing yields down slightly. However, increased liquidity often compensates via capital gains.

How do I verify advertised yields?

Request a signed tenancy contract (Ejari) or bank rental statement before committing. Dubai Invest can arrange third-party audits through certified valuers.

Ready to explore? Schedule a free 30-minute strategy call

Dubai Invest specialises in guiding Australians through the entire acquisition cycle – from suburb selection to remote handover and property management. Book a consultation at dubaiinvest.com.au/contact and receive a tailored yield map based on your budget and risk profile.

Disclaimer: This article is for educational purposes and does not constitute financial advice. Past performance is not a guarantee of future returns.