Why Australian investors need a UAE bank account

Whether you are purchasing an off–plan apartment on Sheikh Zayed Road or launching a tech start-up in Dubai Internet City, having a local dirham (AED) account unlocks three decisive advantages for Australians:

- Faster settlement and lower transfer costs when paying developers, landlords or suppliers.

- Eligibility for UAE residency visas, mortgages and credit lines that require funds to be parked in a local institution.

- Seamless profit repatriation thanks to double-tax treaties and multi-currency facilities offered by regional banks.

In 2025, most major UAE banks allow foreigners to open both personal and corporate accounts, yet the compliance bar has risen sharply since the rollout of enhanced KYC/AML rules. The good news? With the right preparation—and a partner like Dubai Invest—the entire process can still be completed in as little as two weeks.

Personal vs corporate accounts: decide first

| Account type | When you need it | Typical balance requirement | Key documents |

|---|---|---|---|

| Personal resident | You hold (or plan to obtain) a UAE residence visa | AED 3,000–10,000 | Passport, Emirates ID, visa page, proof of address, AU bank statements |

| Personal non-resident | Pure investment play; no UAE visa | Often AED 100,000+ (or currency equivalent) | Passport, Australian proof of address, source-of-funds evidence, statement of investment purpose |

| Free-zone company | You form an LLC in a free zone (e.g., IFZA, DMCC) | AED 50,000+ share capital (varies) | Trade licence, MoA, incorporation cert., shareholder passports, board resolution |

| Mainland company | You trade onshore or own property through an SPV | From AED 100,000 | Same as free-zone plus Ministry of Economy attestation |

Choosing incorrectly can double your paperwork. If your main objective is property only, a personal non-resident account usually suffices. Planning to flip units, collect rent, or hire staff? A free-zone corporate account streamlines incoming and outgoing transactions and may reduce tax exposure after the UAE Corporate Tax rules (June 2023).

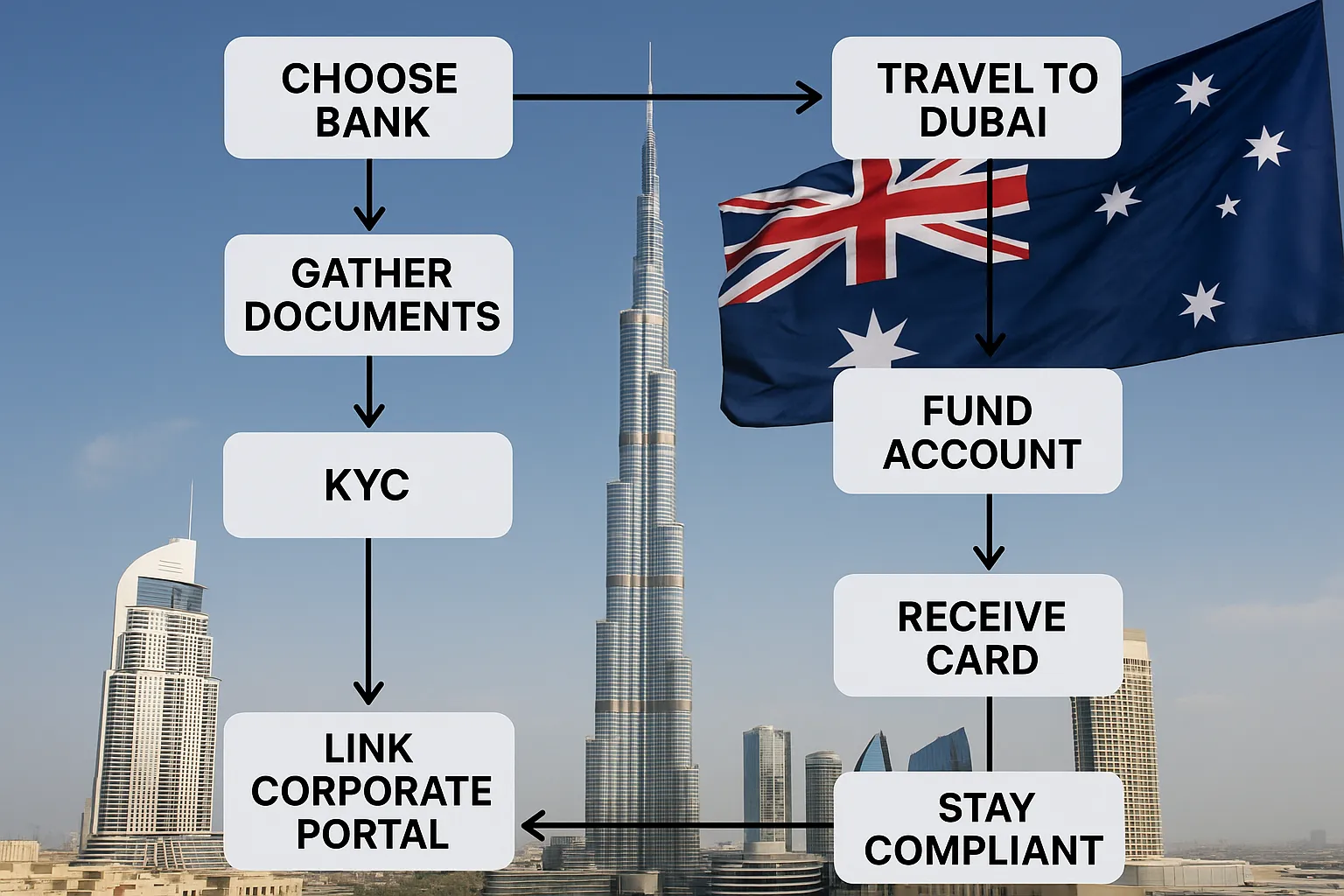

Step-by-step guide for Australians (2025 edition)

1. Shortlist the right bank

As of July 2025, five institutions dominate the Australian investor segment:

- Emirates NBD – broad branch network, English-first digital banking, property escrow experience.

- Mashreq – flexible on minimum balances and quick corporate onboarding via smartBUSINESS portal.

- ADCB – popular for multi-currency (AED, AUD, USD, EUR) personal accounts in one IBAN.

- RAKBANK – comparatively lower fees; ideal for free-zone SMEs.

- HSBC Middle East – smooth global transfers to HSBC Australia but higher balance thresholds.

Pro tip: Digital banks Wio (corporate) and Liv. (personal) are worth considering for e-commerce founders, yet they still ask for Emirates ID, making them impractical for pure non-resident buyers.

2. Gather your compliance file in Australia

Before you board the plane (or start a remote application), compile:

- Passport certified copy (a JP in Australia is accepted)

- Australian driver licence or utility bill (<= 3 months) as proof of residential address

- 6–12 months of AU bank statements showing salary, dividends or sale of assets

- Tax returns or notice of assessment to evidence lawful income

- If buying property: signed Sales & Purchase Agreement (SPA) or reservation form

Scanning everything to PDF with readable colour stamps speeds up the bank’s back-office review.

3. Choose your onboarding route: in-person vs remote

- In-person: fly to Dubai, book a branch appointment (Dubai Invest can set this up), complete biometric verification, walk out with IBAN in 48 hours.

- Remote: possible with Emirates NBD and Mashreq for non-resident personal accounts—but you must courier wet-ink forms and later visit within 90 days for final signature.

Most Australian investors pair a brief 3-day scouting trip with onsite account opening to avoid courier delays.

4. Complete initial KYC interview

Expect questions like:

- What is the exact source of funds for your AED deposits?

- Will you transfer money from a personal or corporate account in Australia?

- How often do you plan to transact each month?

Be transparent—UAE banks share suspicious-transaction reports through the Financial Intelligence Unit (FIU), and vague answers can sink your application.

5. Fund the account and meet minimum balance

Once your IBAN is active, the bank usually gives you 30 days to credit the minimum. You have three options:

- Direct SWIFT transfer from your Australian bank (AUD → AED, FX fee 0.5–1.2 %).

- Using a specialist FX platform like Wise Business or OFX to lower spreads (0.3–0.6 %).

- Hand-carry a bank cheque in USD or AUD—but declare amounts above AED 60,000 at customs.

6. Activate online banking and debit card

Your debit card (Visa or Mastercard) arrives within 3–7 business days. Use it to pay developer milestone invoices, furniture packages or everyday expenses while in town. Activate SMS OTP on an Australian mobile number—major carriers work fine on roaming.

7. (Corporate only) Link to your free-zone portal

For corporate accounts, upload the IBAN to your free-zone dashboard (e.g., IFZA Business Portal). This unlocks e-services such as shareholder visas, labour quotas and audited-financial uploads.

8. Maintain compliance year-round

- Update the bank on any change of address, Australian tax residency or shareholding.

- File Economic Substance Regulations (ESR) and Ultimate Beneficial Owner (UBO) declarations annually if you hold a company account.

- Keep balances above the minimum to avoid hefty fall-below fees (often AED 150–250 per month).

Timeline at a glance

- Pre-screening call with Dubai Invest advisor – 1 day

- Document compilation & notarisation – 3–5 days (in Australia)

- Branch appointment & KYC – 1 day (Dubai)

- IBAN activated – 1–2 days

- Card & online banking live – 3–7 days

Total: 6–14 calendar days if you prepare correctly.

Common hurdles and how to avoid them

- Insufficient proof of source of funds – bring sale contracts, dividend statements, or crypto-to-fiat trace reports if relevant.

- Name mismatch between passport and AU utility bill – ensure both list middle names or none.

- US ties (passports or green cards) – triggers FATCA paperwork; allocate an extra day.

- Inactive Australian company used as funding entity – renew ASIC filings first or use a personal transfer instead.

Dubai Invest pre-screens your file to flag these red lights before the bank sees them.

Cost breakdown (personal non-resident account)

- Account opening fee: AED 0–2,500 (bank dependent)

- Monthly maintenance: waived if you park the minimum balance; else AED 105–315

- Debit card annual fee: AED 200–300

- International transfer (AED→AUD): AED 50 + FX spread (~0.25 %)

Corporate accounts incur slightly higher charges plus cheque-book fees.

Tax considerations for Australians

- No personal income tax in the UAE, but Australian tax residents must declare worldwide income. Rental yields from Dubai property are assessable in Australia, offset by foreign-tax credits if you pay the 5 % UAE rental tax.

- Corporate Tax (9 %) applies from June 2023 on UAE-sourced profits above AED 375,000. Many free-zone entities remain exempt if they earn qualifying income and meet substance tests.

- DTAA: Australia and the UAE signed a double-tax agreement in December 2023 (awaiting ratification). Once active, it should mitigate double taxation on dividends and capital gains.

Consult a cross-border accountant to align bank statements with your ATO obligations.

Frequently asked questions (FAQ)

Can I open a UAE bank account entirely online from Australia?

Not yet. Some banks start remotely but still demand a physical visit within 90 days for identity verification.

What happens if my balance drops below the required minimum?

A fall-below fee is automatically debited each month. Repeated breaches may lead to account closure.

Does holding a UAE account give me residency?

No. Residency comes via employment, property investment (≥ AED 2 million), or company formation. The account is a supporting requirement, not the visa itself.

Can I link the account to my Australian Xero file?

Yes—Emirates NBD, Mashreq and ADCB export OFX or CSV statements compatible with Xero and MYOB.

Next steps: open your account with zero guesswork

Opening a Dubai bank account as an Australian isn’t difficult—if you tackle compliance proactively and choose the right institution. Dubai Invest coordinates branch slots, pre-approves your documentation, and accompanies you on the day, shaving weeks off the timeline.

Ready to get started? Book a free 30-minute consultation with our banking team and walk into your chosen branch with confidence:

Invest smart. Set up seamlessly. Your gateway to Dubai starts with an IBAN.