How much does it really cost to form a Dubai Mainland LLC in 2025?

Ask five incorporators and you will hear five different figures—anything from AED 20,000 to well north of AED 100,000. The truth sits somewhere in between and depends on the business activity, visa quota, and—crucially—the service providers you engage. Below, we unpack every fee line item Australians are likely to face when setting up a Limited Liability Company on the Dubai mainland this year, so you can budget confidently and avoid last-minute surprises.

Currency note: All figures are in United Arab Emirates dirhams (AED). To convert to Australian dollars, divide by roughly 2.4 (based on July 2025 FX rates). Always check the live rate before wiring funds.

1. Why choose a mainland LLC over a free-zone company?

- Broader trading rights: Sell directly to the UAE market without appointing a local distributor.

- Multiple office locations: Lease office or retail space anywhere in Dubai rather than being confined to a single free zone.

- Government contracts: Certain tenders are open only to mainland entities with an Emirati shareholder.

- Unlimited visa quota (space permitting): Handy for teams that will scale beyond a handful of resident employees.

For Australians expanding into the Gulf, these flexibilities often outweigh the extra paperwork of engaging a 51 % Emirati partner (now typically arranged via a profit-withdrawal side agreement).

2. One-off formation fees in 2025 (government & mandatory services)

| Stage | Government body | Typical cost (AED) | Comments |

|---|---|---|---|

| Trade name reservation | Dubai Economy & Tourism (DET) | 620 | Valid 6 months; “premium” names cost more |

| Initial approval | DET | 120 | Security clearance for the activity & owners |

| Memorandum of Association drafting & e-notarisation | DET + Notary Public | 1,500–2,000 | Tasheel typing service included |

| Licensing fee (commercial or professional) | DET | 10,000–15,000 | Activity-based; tourism, finance & engineering are at the upper end |

| Corporate register & Chamber of Commerce certificate | Dubai Chamber | 1,200 | Mandatory for import/export & many tenders |

| Immigration Establishment Card | Federal Authority for Identity, Citizenship, Customs & Port Security | 675 | Valid 3 years |

| MOHRE labour file & e-quota | Ministry of Human Resources & Emiratisation | 2,000–7,000 | First visa quota (0–3 visas) often discounted |

| Investor visa package (3-year) | ICP + DHA | 2,965 | Entry permit, status change, medical, Emirates ID, stamping |

| Subtotal (single-visa, desk-only set-up) | ≈ 29,000 | Excludes sponsor & office rent |

2.1 Local service agent / Emirati shareholder fee

While the 2021 Company Law reform allows 100 % foreign ownership in many sectors, mainstream trading and contracting activities still require a UAE national to hold at least 51 % of shares. The “silent partner” or local service agent typically charges AED 8,000–20,000 per year, depending on activity risk and role (signatory vs. non-signatory).

2.2 Office or warehouse lease

A mainland licence cannot be issued on a virtual address; you need Ejari-registered premises:

- Flexi desk in a business centre: AED 12,000–18,000/year (good for consultancies)

- Small shell-and-core office (200 sq ft) in Deira or Business Bay: AED 45,000–60,000/year

- Retail shop or warehouse: From AED 80/sq ft plus 5 % municipality tax

Remember to add the 5 % VAT on lease contracts signed after 2018.

2.3 Optional—but inevitable—bank account costs

Most Dubai banks now require a minimum average balance of AED 50,000–150,000 for new foreign-owned SMEs. Falling below triggers monthly fees of AED 250–500. Factor in AED 1,000–2,500 for account opening due-diligence charges.

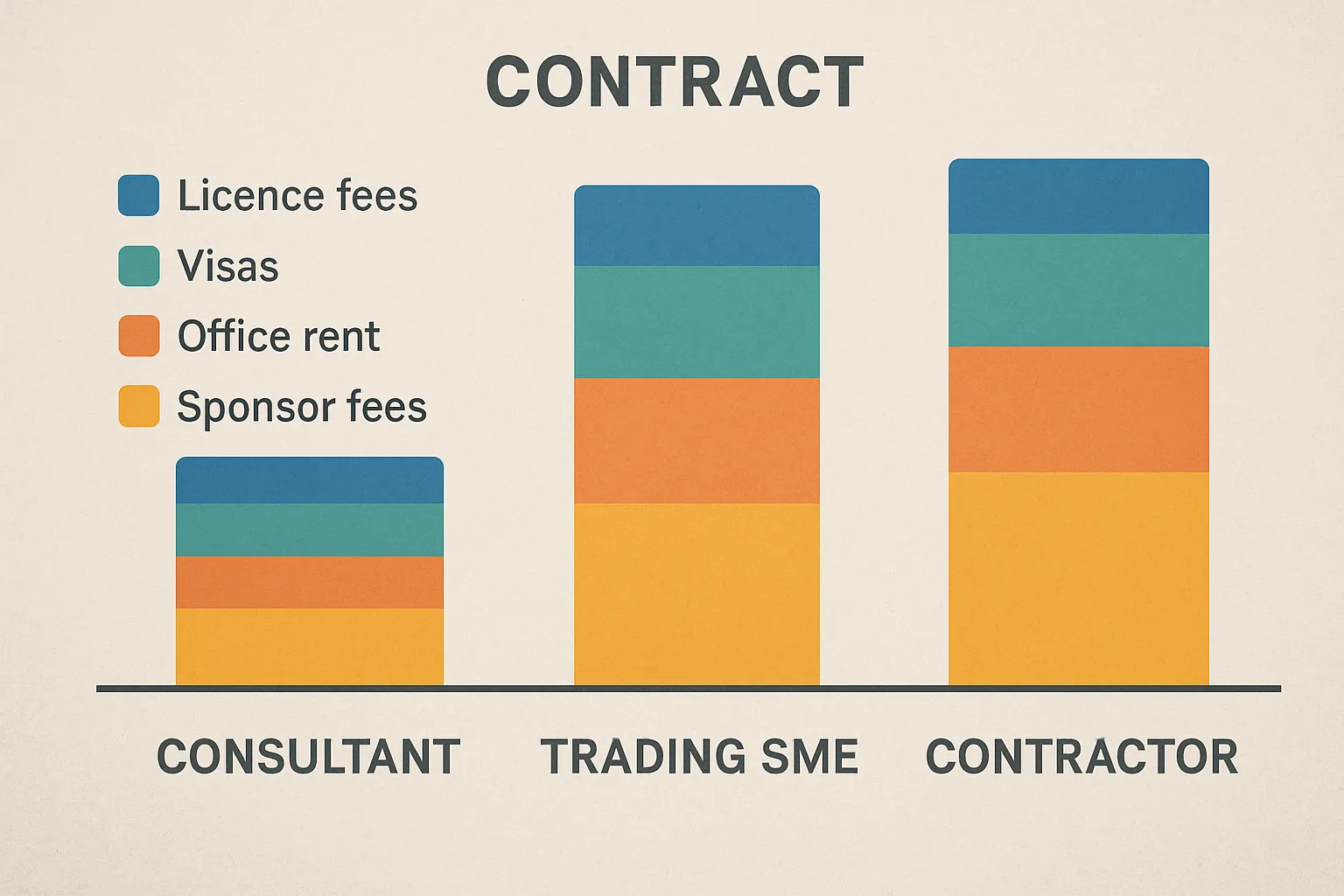

3. Sample cost scenarios for 2025

- Solo digital consultant, 1 visa, flexi desk

- Government & visa fees: AED 29,000

- Local sponsor: AED 10,000

- Flexi desk: AED 15,000

Total: AED 54,000 (≈ AUD 22,500)

- Trading company importing consumer goods, 3 visas, small office

- Government & 3 visas: AED 46,500

- Local sponsor: AED 15,000

- Ejari office (200 sq ft): AED 55,000

- Bank compliance/setup: AED 2,500

Total: AED 119,000 (≈ AUD 49,600)

- Civil construction contractor, 10 visas, warehouse + vehicles

- Government & 10 visas: AED 103,000

- Local partner (signatory): AED 25,000

- Warehouse lease: AED 180,000

- Heavy-vehicle registration & insurance: AED 60,000

Total: AED 368,000 (≈ AUD 153,000)

4. Recurring annual costs you should not overlook

- Licence renewal: Roughly 70 % of the initial licence fee (AED 7,000–12,000) plus Chamber renewal (AED 1,200).

- Sponsor renewal retainer: Same AED 8,000–20,000 every year, unless your activity becomes 100 % foreign-ownable and you restructure.

- Office rent escalation: Standard 5 % yearly uplift unless pegged differently in the lease.

- Employee visa renewals: AED 3,200–3,800 per person every two years.

- Corporate tax compliance: From June 2024, mainland LLCs pay 9 % on profits above AED 375,000. Budget AED 10,000+ per year for tax filing and transfer-pricing documentation if applicable.

5. 2025 regulatory changes affecting your budget

- Economic Substance filings now mandatory for most service businesses—non-compliance penalties reach AED 50,000.

- ESG reporting pilot for construction and hospitality licences, adding consultancy costs in the AED 5,000–15,000 range.

- Higher medical-fitness fees (up 12 % vs. 2024) and compulsory golden-card upgrade for high-risk nationals.

- AML/CFT audits: Trading licences dealing in high-value goods must appoint a compliance officer (typical salary AED 12,000/month).

Staying ahead of these rules saves both cash and reputation. A local adviser who tracks circulars from DET and MOHRE is worth their fee.

6. Cost-saving tips for Australian founders

- Pick the lowest-risk activity that still covers your operations. Adding extra activities later costs only AED 500.

- Negotiate an annual cap with your local partner instead of percentage-based profit sharing.

- Bundle visas: Applying for three or more at once trims Tasheel typing charges by 10–15 %.

- Lock in a two-year lease in districts such as Al Quoz or JLT before Expo 2030 construction absorbs vacant stock.

- Consider a hybrid structure: A mainland LLC for on-shore sales + a free-zone branch for warehousing in Jebel Ali FTZ can reduce customs guarantees.

7. Mainland vs. free zone: quick cheat sheet

| Feature | Mainland LLC | Popular Free Zone (e.g., DMCC) |

|---|---|---|

| Trade within UAE market | Direct, no distributor required | Via local agent or branch |

| Office requirement | Mandatory Ejari lease | Flexi desk allowed in most zones |

| Local shareholder | Often 51 % Emirati (activity dependent) | 0 % |

| Corporate tax 2025 | 9 % above AED 375k | Same rate unless qualifying FZP* |

| Typical first-year cost (1 visa) | AED 54k | AED 35k |

*Qualifying free-zone persons enjoy 0 % on qualifying income, but strict substance tests apply.

8. Next steps

- Book a costed proposal: Dubai Invest’s mainland setup team can prepare a line-by-line quotation tailored to your activity and visa headcount—usually within 24 hours.

- Request real-time AUD pricing: We lock FX for 48 hours through our banking partners to shield you from rate swings.

- Schedule a free Zoom consult: Speak to a licensed corporate adviser who has moved from Sydney to Dubai and understands both tax systems.

Questions? Reach us via the live chat on dubaiinvest.com.au/contact or call our Melbourne office on (03) 9016 9121 during AEST business hours.

Bottom line

Setting up a Dubai mainland LLC in 2025 is not cheap, but neither is it the black box it once was. For an Australian solo founder, AED 54,000–60,000 (≈ AUD 23,000–25,000) covers every compulsory government fee, a flexi desk, and a trustworthy local sponsor. As your headcount and office footprint grow, expect proportionate uplifts, primarily driven by rent and visas. With clear budgeting—and a partner who knows the system—you can turn those dirhams into an on-shore presence that unlocks the entire UAE market.