Understanding Ownership in the UAE – Why It Matters for Australians

Signing a property contract in Dubai is not quite the same as buying in Sydney or Perth. The headline price per square metre may look tempting, but the type of title you receive will define everything from how long you can keep the home to whether your children inherit it one day. In Dubai, ownership falls into two broad categories: leasehold and freehold. Navigating the fine print is critical for any foreign buyer, and doubly so when you live 11,000 km away.

In 2024, 83 % of Australian purchasers in Dubai chose freehold units, yet leasehold still offers niche advantages in certain master-planned communities (Dubai Land Department statistics, March 2025).

This guide unpacks both structures, the legal framework behind them, and the strategic questions you should ask before wiring your deposit.

1. The Legal Basics

- Freehold: You own the property and the land it stands on outright, in perpetuity. Your name (or your company’s) is registered at the Dubai Land Department (DLD), comparable to Torrens Title in Australia.

- Leasehold: You buy the right to occupy or sub-lease the property for a fixed term—commonly 30, 50 or 99 years—while the master developer retains the underlying land. Think of it as a very long lease (a bit like Crown land leases in the Northern Territory).

Both routes are 100 % legal for expatriates, but they sit under different statutes:

- Freehold titles are governed by Law No. 7 of 2006.

- Leasehold interests are covered by Law No. 26 of 2007 (Dubai Tenancy Law) and Law No. 33 of 2008.

For deeper reading, the DLD maintains English translations of these laws (see dld.gov.ae).

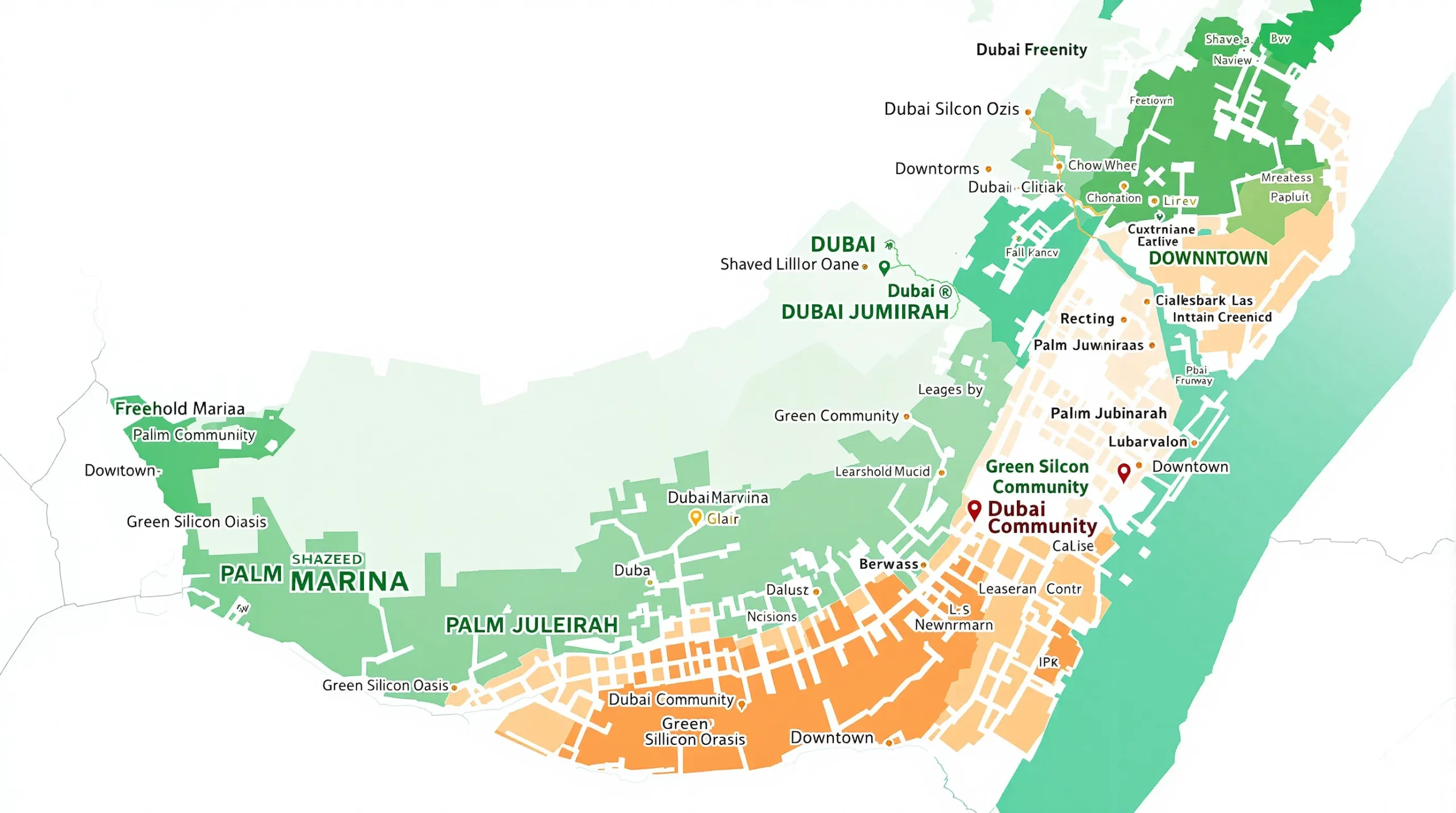

2. Geographic Availability

- Freehold Zones: Palm Jumeirah, Dubai Marina, Downtown, Business Bay, Jumeirah Village Circle, Dubai Hills Estate, most of Dubai South.

- Predominantly Leasehold Zones: Green Community (Dubai Investments Park), Dubai Silicon Oasis, parts of Mirdif, certain pockets in Deira.

The mix is evolving—several communities that were leasehold a decade ago have since been re-zoned to freehold. Always confirm the latest status with your conveyancer or a Dubai Invest advisor.

3. Key Differences at a Glance

| Factor | Freehold | Leasehold |

|---|---|---|

| Ownership duration | Unlimited | Fixed term (30–99 years) |

| Land rights | Yes | No |

| Ability to renovate structurally | Subject to developer & municipal approval | Usually restricted |

| Heir & succession rights | Full | Lease continues until term expiry |

| Typical price per sq m | 5–12 % premium | Slight discount |

| Mortgage availability | Widely offered by UAE banks & some Australian lenders | Limited panel of lenders |

| Resale liquidity | High | Moderate to low |

4. Financial Implications for Aussie Buyers

Capital Appreciation

Historically, freehold districts such as Downtown and Palm Jumeirah have delivered higher compounded annual growth rates (CAGR) than leasehold areas, largely thanks to overseas demand and scarcity value. According to Property Monitor (Q1 2025):

- Freehold apartments averaged 6.8 % CAGR over 10 years.

- Leasehold averaged 4.1 % CAGR.

Rental Yield

Leasehold can shine here: developers sometimes bundle property management and high-spec furnishing into the lease model, enabling gross yields of 7–9 % versus 5–7 % in comparable freehold stock. If cash flow is your top KPI, a 50-year lease in Dubai Silicon Oasis student housing might outperform a freehold Marina studio.

Financing & LVRs

While Australian banks rarely collateralise UAE real estate, several UAE lenders—Emirates NBD, Mashreq, ADCB—extend mortgages to non-resident Australians. Standard terms in 2025:

- Freehold: up to 75 % loan-to-value, 25-year tenor.

- Leasehold: typically 50–60 % LTV, restricted tenor capped to lease expiry minus five years.

Tip: Speak with Dubai Invest’s partnered brokers for pre-approval before you pay a booking fee.

Service Charges

Both models incur annual owners’ association (OA) fees. Leasehold projects sometimes bundle ground rent into OA dues, inflating the headline figure. Scrutinise the breakdown—Dubai Invest’s due-diligence checklist highlights hidden escalations that can erode yield.

5. Lifestyle & Visa Considerations

Owning freehold residential property worth at least AED 2 million (~AUD 830 000) makes you eligible for a 10-year Golden Visa. Leasehold property currently does not qualify for the Golden Visa, though a 2-year renewable investor visa may apply if the property value exceeds AED 750 000.

For Australians planning partial relocation or long-term remote work in Dubai, the visa angle alone can justify paying the freehold premium.

6. Common Myths – Debunked

- “Leasehold property loses all value when the term ends.”

The right reverts to the master developer, but Dubai law allows renegotiation or renewal at market rates. Nevertheless, banks depreciate value aggressively after the halfway mark. - “Foreigners cannot inherit Dubai property.”

Foreign heirs can inherit freehold real estate via a DIFC Will or a UAE local court process. Leasehold interests pass to heirs for the remainder of the term. - “Service charges are higher in freehold communities.”

Not automatically—master-planned freehold areas often have economies of scale that keep OA fees competitive.

7. Decision Framework: Five Questions to Ask Yourself

- Investment Horizon: Are you targeting a 5-year flip, or a legacy asset for your children?

- Cash Flow vs Capital Gain: Is annual yield more important than eventual resale price?

- Visa Objectives: Do you need residency to manage a Dubai-based business or enjoy tax breaks?

- Financing Strategy: Can you fund 40–50 % equity if banks limit LTV on leasehold?

- Exit Liquidity: Would you struggle to sell a 30-year lease after 10 years when only 20 years remain?

A balanced portfolio might include one freehold unit in a prime location for appreciation plus a high-yield leasehold in an emerging tech hub such as Dubai Silicon Oasis.

8. How Dubai Invest Streamlines the Process for Australians

- Title Verification: Our conveyancing partners cross-check all DLD records and OA bylaws.

- On-Ground Inspections: We conduct 4K walkthrough videos and drone imagery so you can assess remotely.

- Financing Facilitation: Through MoUs with Emirates NBD and ADCB, we fast-track mortgage approvals for non-residents.

- Legal Structuring: Need to hold via an offshore entity or a Dubai Free Zone company? Our legal team aligns property ownership with your broader tax planning.

- After-Sales Management: From tenant sourcing to snagging inspections, our property management arm keeps yields on track.

Explore the full service list at Dubai Invest Real Estate Services.

FAQs

Is leasehold ever converted to freehold in Dubai?

Occasionally. For instance, parts of Jumeirah Lakes Towers saw selected towers offered freehold extensions in 2022. Conversions require RERA and developer approval; costs vary.

Can I get an Australian bank loan against Dubai property?

Rarely. Most local banks in Australia won’t secure overseas property. However, some customers leverage equity in Australian homes to raise capital, then pay cash in Dubai.

What happens if the developer goes bankrupt?

Projects are escrow-protected. The DLD may appoint a new developer or liquidate assets to refund investors. Dubai Courts have precedence for safeguarding purchaser funds.

Are property taxes lower for leasehold?

Dubai has no annual property tax for either structure. You’ll pay a 4 % registration fee on purchase and OA fees thereafter.

Does owning freehold mean I can operate a business from the premises?

No, zoning rules apply. Residential freehold does not grant commercial licensing rights. Consult our Business Setup division about Dubai Free Zone company formation.

Ready to Make Your Move?

Whether you’re eyeing a 99-year lease in a tech park or a beachfront freehold villa, the Dubai Invest team can run the numbers, arrange inspections, and negotiate contracts—all while you stay in Australia. Book a complimentary 30-minute strategy call today and step into Dubai’s property market with confidence.