The clock is ticking. Your SaaS idea is validated, seed capital is secured and you have decided Dubai will be home base for global expansion. The only question left: how fast can you turn that concept into a fully licensed company? With the right roadmap, the answer is less than a month.

Dubai’s government-backed digital portals, streamlined KYC requirements and founder-friendly free zones make it possible to launch a tech startup in record time. Follow the 30-day playbook below and you will move from idea to licence before the next billing cycle of your favourite project-management tool.

Why Dubai is the go-to launchpad for Aussie founders in 2025

- Zero corporate tax on qualifying free-zone profits until 2029 (Federal Decree-Law No. 47).

- 100% foreign ownership without a local sponsor in more than 40 free zones.

- Time-zone overlap that lets teams collaborate with Asia in the morning and Europe in the afternoon.

- World-class connectivity (Tier-1 cloud regions from AWS, Microsoft and Oracle are already live).

- Fast-track residency visas for founders, employees and family members.

According to Startup Genome’s 2024 Global Startup Ecosystem Report, Dubai cracked the global top 15 for talent and experience, outranking Berlin and Toronto on early-stage funding per startup.

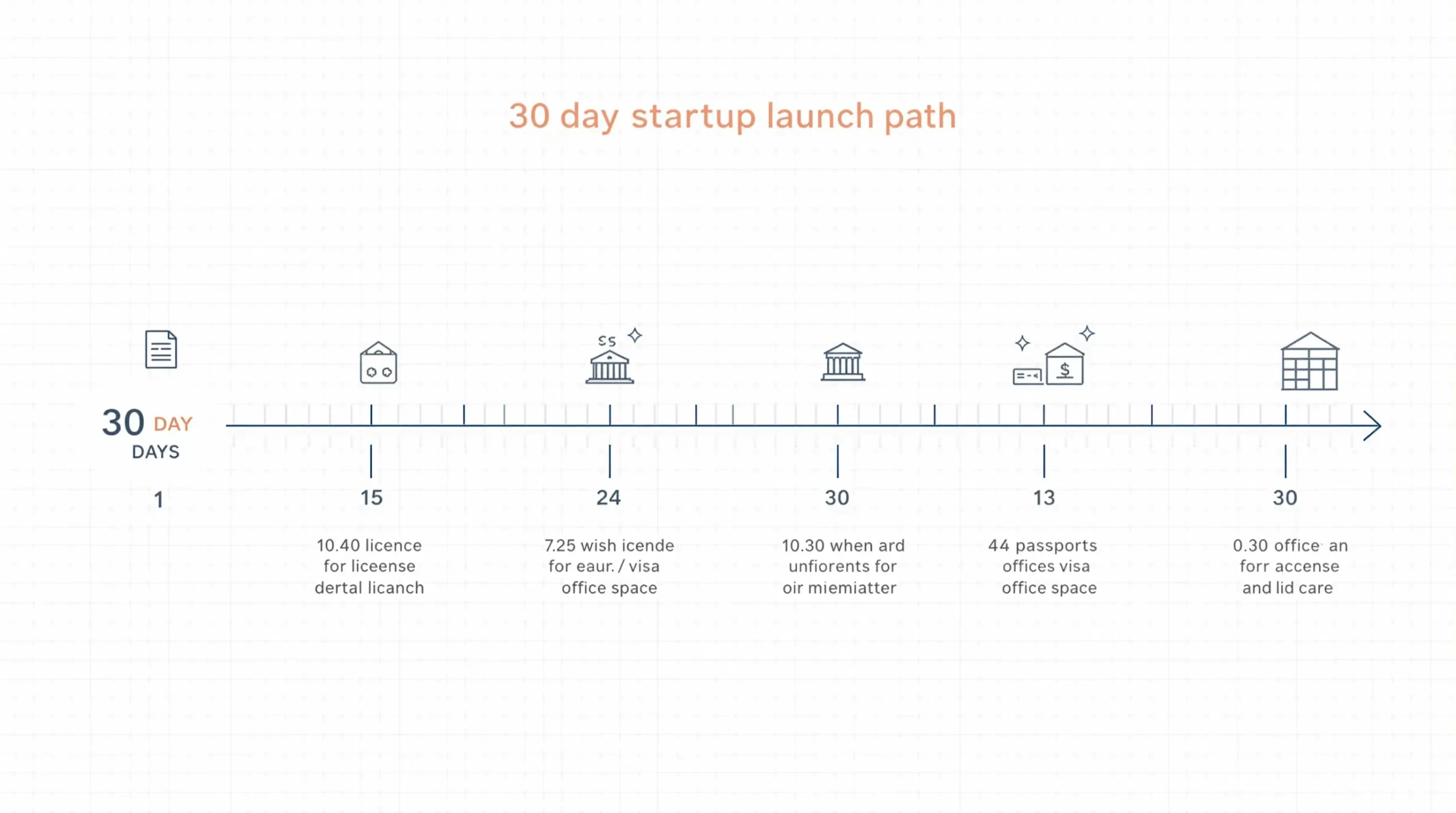

The 30-Day Roadmap at a Glance

| Day | Milestone | Key Deliverables |

|---|---|---|

| 0 | Prep from Australia | Idea validation, pitch deck, secured capital |

| 1-3 | Choose jurisdiction | Free zone selection, engage Dubai Invest service advisor |

| 4-5 | Trade name reservation | 3 name options, AED 620 fee |

| 6-7 | Initial approval | Passport copy, NOC if UAE resident |

| 8-14 | Paperwork & payment | Attested documents, licence fee, office lease in principle |

| 15-18 | Receive licence | Digital PDF issued via free zone portal |

| 19-22 | Bank account opening | KYC interview, proof of address, business plan |

| 23-25 | Visa quota & entry permit | Medical insurance, Emirates ID biometrics |

| 26-29 | Office fit-out & e-invoicing registration | Flexi-desk or co-working subscription |

| 30 | Go live | First client contract signed under UAE law |

Let’s unpack each step.

Day 1-3: Picking the right free zone (and why it matters)

Choosing where to incorporate sets the tone for taxes, compliance and investor perception. Tech startups typically shortlist one of four zones:

- Dubai Internet City (DIC) – prestige address, established ecosystem, higher costs.

- Dubai Silicon Oasis (DSO) – in-house data centre, R&D labs, proximity to universities.

- IFZA Dubai – fast digital onboarding, competitive multi-year packages.

- Dubai Airport Free Zone (DAFZ) – ideal for hardware or logistics heavy models.

Key selection criteria:

- Activity list compatibility (e-commerce, software development, AI consultancy etc.).

- Cost of share-capital requirements (most zones waive paid-up capital for tech activities).

- Visa quota (1 visa per 8–12 sqm of office space is the norm).

- Investor sentiment (some VCs prefer DIC or DIFC for fintech plays).

Dubai Invest offers a side-by-side matrix of these factors during your first consultation, saving days of Google trawling.

Day 4-7: Name reservation and initial approval

Reserve your trade name on the zone’s self-service portal. Acceptable names cannot reference religion or global brands and should end with the legal suffix (for example, Techbox FZ-LLC).

Documents for initial approval:

- Passport copy (coloured, valid 6+ months).

- Current UAE visa copy (if you already reside in the GCC).

- CV/resume outlining relevant experience (some zones ask for founder track record).

- No-objection certificate from your Emirates sponsor, if applicable.

Approval typically lands within 48 hours. You will receive a payment voucher for the main licence fee.

Day 8-14: Submitting the full package

The “heavy lift” week covers notarisation, legalisation and fee payment.

Checklist:

- Specimen signature form (ink signed, then scanned).

- Power of attorney (if you are appointing Dubai Invest to sign on your behalf).

- Shareholder resolution (only if multiple founders).

- Lease agreement for a flexi-desk or private office. Most tech founders opt for a co-working licence (from AED 7,500 year one).

Expect upfront costs between AED 19,000 and AED 29,000 (AUD 7,800–12,000) depending on zone and visa allocation.

At this stage 100% of the process can be completed remotely. Courier fees for original documents are minimal and many zones now accept DOCUSIGN.

Day 15-18: Licence issued (the moment investors wait for)

Once payment clears, the free zone will email a digitally signed licence. This is your golden ticket to:

- sign client contracts under UAE law

- subscribe to local cloud services (Etisalat, du)

- register on government tender portals

Print a copy, upload it to your data room and announce the milestone on LinkedIn.

Day 19-22: Banking without headaches

Opening a corporate bank account used to be the bottleneck. Recent fintech competition between Wio Bank, RAK Digital and Mashreq Neo has slashed onboarding to 3–5 working days for clean tech profiles.

Tips for friction-free approval:

- Provide a concise business plan with 12-month cash-flow forecast.

- Show an Australian utility bill and tax assessment as proof of address.

- Clarify expected monthly turnover and top 3 client geographies.

Dubai Invest maintains direct relationship managers at each bank and can pre-screen your file, saving you another week.

Day 23-25: Securing your founder visa

A free-zone establishment card permits you to apply for the entry permit (valid 60 days for activation). Key steps:

- E-medical test (blood and chest X-ray, 20 minutes).

- Emirates ID biometrics.

- Health-insurance policy purchase (starts at AED 900 annually for basic coverage).

Once the visa stamp hits your passport you can sponsor dependants and begin hiring.

Day 26-29: Office, compliance and e-invoicing

- Flexi-desk packages meet legal substance rules while keeping overhead low. Popular hubs include AstroLabs and DIFC Innovation Hub.

- E-invoicing registration with the Federal Tax Authority is mandatory from July 2025 for all B2B suppliers. Dubai Invest will enrol your venture on EmaraTax and integrate Digital Signature Certificates.

- ESR notification (economic substance regulations) must be filed within six months of year-end, even if you claim the tech service exemption.

Day 30: Launch day

Congratulations. You are officially operational.

Speed hacks that shave off extra days

- Pre-attest all documents at the UAE Embassy in Canberra before Day 0.

- Bundle multi-year licences – IFZA offers 2- or 3-year packages that waive subsequent renewal visits.

- Use digital banking – Wio Business opens accounts fully remote with facial recognition.

- Draft your shareholder agreement in parallel rather than after licence issuance.

- Book medical screening through the VIP lane (AED 700) to receive Emirates ID within 24 hours.

Common missteps (and how to avoid them)

- Wrong activity code – selecting “IT consultancy” when your revenue model is SaaS subscription can trigger VAT confusion later.

- Over-promising revenue during bank KYC – unrealistic projections raise money-laundering red flags.

- Ignoring data localisation – the amended Cybersecurity Law requires certain fintech data be hosted in UAE servers.

- Leaving ESR filing to year end – fines start at AED 20,000.

Micro case study: Sydney founder pivots to Dubai

When Amy Leung couldn’t scale her AI document-processing tool inside Australia due to procurement cycles, she looked east. With Dubai Invest handling incorporation, Amy secured an IFZA licence in 17 days, opened a Wio Business account in three and onboarded her first GCC client the following month. “The time zones are perfect,” says Amy, “and I kept my Australian PTY for domestic contracts while booking MENA revenue through the FZ-LLC.”

Frequently Asked Questions (FAQ)

How much capital do I need to show for a tech licence?

Most free zones no longer ask for paid-up capital for services activities, though you may declare AED 10,000–50,000 in the MOA. No deposit is taken.

Can I keep working from Australia after I get the UAE licence?

Yes. A flexi-desk satisfies the domicile requirement. However, to activate your residency visa you must enter Dubai at least once.

Is corporate tax really zero?

Free-zone income that meets qualifying criteria (substance, audited accounts, no mainland revenue) is taxed at 0%. Non-qualifying income may face 9% federal CIT.

What about intellectual property?

You can register trademarks with the UAE Ministry of Economy in 6-8 months. Patents go through the Gulf Cooperation Council Patent Office.

I heard I need a local sponsor for a .ae domain. True?

False. As a UAE-licensed entity you can directly register .ae and .co.ae domains with accredited registrars.

Ready to start the 30-day sprint?

Dubai Invest has guided more than 200 Australian founders through this exact timeline. Book a free 30-minute strategy call today and receive a customised cost sheet within 24 hours.

Looking for deeper insights? Join us at the upcoming Grand Business Conference (details here: https://dubaiinvest.com.au/conference/) and network with regulators, VCs and fellow tech pioneers.

Invest smart. Set up seamlessly. Your gateway to Dubai starts now.