Part 1: Step-by-Step Guide for Australians Applying for a Dubai Business Visa

Landing the right visa is often the final jigsaw piece that turns a promising Dubai expansion into a live, revenue-generating venture. Yet many Australians still treat the visa application as an administrative after-thought and end up burning weeks – or even losing contracts – because a single form, attestation or bank letter was missing.

At Dubaiinvest’s Business Setup Service, we process dozens of business-visa files each quarter. Below is the streamlined, insight-heavy roadmap we share with clients, alongside hard data and real-world lessons gleaned from Jomon’s 12-plus years building and scaling companies in the UAE.

1 Match Your Expansion Goal to the Right Visa Category

| Visa Route | Typical Use-Case for Aussies | Ownership Requirement | Processing Time (calendar days) | Up-front Cost (AUD, 2025) |

|---|---|---|---|---|

| Investor/Partner Visa (Mainland LLC) | Scaling B2C/B2B sales inside UAE | Min. 1 share in mainland company | 21–28 | 6,200–7,000 |

| Free-Zone Investor Visa | Regional HQ, IP holding, e-commerce exports | 100 % foreign ownership | 14–21 | 5,400–6,000 |

| Green Visa (Freelancer/Self-Employed) | Solo consultants, digital nomads | Proof of min. AED 360k income over 2 years | 15–20 | 4,100–4,700 |

| Golden Visa (10 Years) | Asset protection, family relocation | AED 2 m property or AED 2 m capital | 30–45 | 10,500–11,800 |

Source: UAE ICP & free-zone authorities, fee schedules converted at AUD 1 = AED 2.40 (Oct 2025).

The free-zone investor visa still dominates for Australian SMEs: 61 % of Dubaiinvest’s 2024–Q3 visa mandates fell into this bucket. But early-stage founders who plan to invoice UAE mainland clients should model the mainland LLC route to avoid costly indirect taxes and bank-transfer barriers later.

For a detailed comparison, see our Free Zone vs Mainland guide tailored for Australian founders

Lesson learned: One Melbourne SaaS studio saved AUD 43k in VAT pass-throughs after we switched them from a free-zone structure to a dual mainland branch before the visa was issued.

2 Pre-Approval File: Nail Compliance Before You Board the Plane

Since 2024 the UAE’s visa pre-approval scorecard now factors Ultimate Beneficial Owner (UBO) checks, economic-substance declarations and sanctions screening. Dubaiinvest’s compliance desk flags that 18 % of Aussie applications trigger additional queries – usually an ATO-domiciled trust or a minor director typo.

Quick wins to sail through the filter:

- Use the exact English passport name across trade-licence, MoA and bank reference letters.

- Provide an Australian Federal Police (AFP) certificate issued < 3 months ago – older ones cause 2–3 day RTA delays.

- Submit an economic-substance self-declaration even if exempt; it shortcuts free-zone clarification emails.

3 Medical & Biometrics: Book the Fast-Track Window

The Emirates ID card now controls one-tap e-gate access at DXB and banking token activation. In Dubai Health Authority centres the standard medical-fitness test yields results in 48–72 hours, but the ‘VIP 4-hour’ lane costs only AED 743 extra (≈ AUD 310) – worth every cent when a supplier contract is on the line. We pre-book the slot the same day the entry permit clears immigration.

4 Bank Letter & Capital Proof: Plan for Dual Currencies

Free-zone authorities typically require an AED-denominated bank or FX letter showing at least AED 10k–50k balance. Dubai mainland investors may instead file a paid-up-capital auditor letter. AUD fluctuations matter: a 5 % swing wiped AUD 2,100 off one client’s statement last quarter, pushing him below the threshold. Dubaiinvest hedges this risk by holding the proof funds in a multi-currency account and locking the FX rate 72 hours prior to filing.

5 Visa Stamping & Emirates ID Issuance

After medical clearance, stamped visas arrive inside your passport in 2–4 working days. Emirates ID cards now print and ship within 5 days in Dubai – down from 10 in 2023. Clients can activate E-gate and open local bank accounts with the digital ID immediately via the ICP app.

| End-to-End Timeline Benchmarks |

| Milestone | Fast-Track (days) | Regular (days) |

|---|---|---|

| Pre-approval | 2 | 5 |

| Entry permit | 1 | 3 |

| Medical & ID biometrics | 1 | 3 |

| Visa stamping | 2 | 4 |

| Emirates ID card | 5 | 8 |

| Total | 11 | 23 |

6 Common Pitfalls That Delay Australian Files

- ATO Certificate of Residency missing attestation – Adds 3–6 days.

- Shared-office contracts instead of dedicated flex-desk licence – Mainland inspectors can reject the file.

- Forget to cancel previous UAE visas – Especially with ex-employee dependants; causes ICP red flags.

- Significant shareholder < 21 years old – Triggers parental NOC, often overlooked by first-time founders.

7 Dependants & Family – Sequence Matters

Applying dependants after the principal visa used to be the norm. Under 2025 rules, simultaneous filings are allowed and often faster because biometric appointments can be grouped. Families of four save ~ AUD 600 in courier fees and 7 calendar days using this bundled path.

8 Cost Projection – Mainland vs Free Zone (Single Founder)

| Cost Item | Free-Zone Investor Visa | Mainland Investor Visa |

|---|---|---|

| Trade-licence + establishment card | AUD 4,550 | AUD 5,800 |

| Entry permit & status change | 580 | 640 |

| Medical fast-track & biometrics | 460 | 460 |

| Emirates ID (2 years) | 330 | 330 |

| Visa stamping | 260 | 260 |

| Total | AUD 6,180 | AUD 7,490 |

Excludes optional office lease upgrades, VIP lounges, family dependants.

9 Why Expert Consultation Pays Off

- Lost-opportunity cost: A 14-day visa delay on a contract worth AUD 200k equates to AUD 7,670 per day in deferred revenue (based on Dubaiinvest client averages).

- Regulatory changes: The UAE amended its Federal Decree-Law No. 29 of 2021 in mid-2025, tightening AML affidavits for foreign shareholders – changes many DIY applicants missed.

- Network leverage: Jomon’s on-ground relationships at ICP counters fast-track ad-hoc clarifications that online portals cannot.

“We tried the paperwork ourselves and got stuck at the medical-fitness upload for ten days. Jomon’s team cleared it in six hours and we still signed our first UAE client on schedule.”

– James K., Brisbane fintech founder

Ready to secure your visa without the headaches?

Book a consultation with Dubaiinvest and let our experts guide your UAE expansion from visa filing to launch day.

Frequently Asked Question

What is the process for Australians applying for a Dubai business visa?

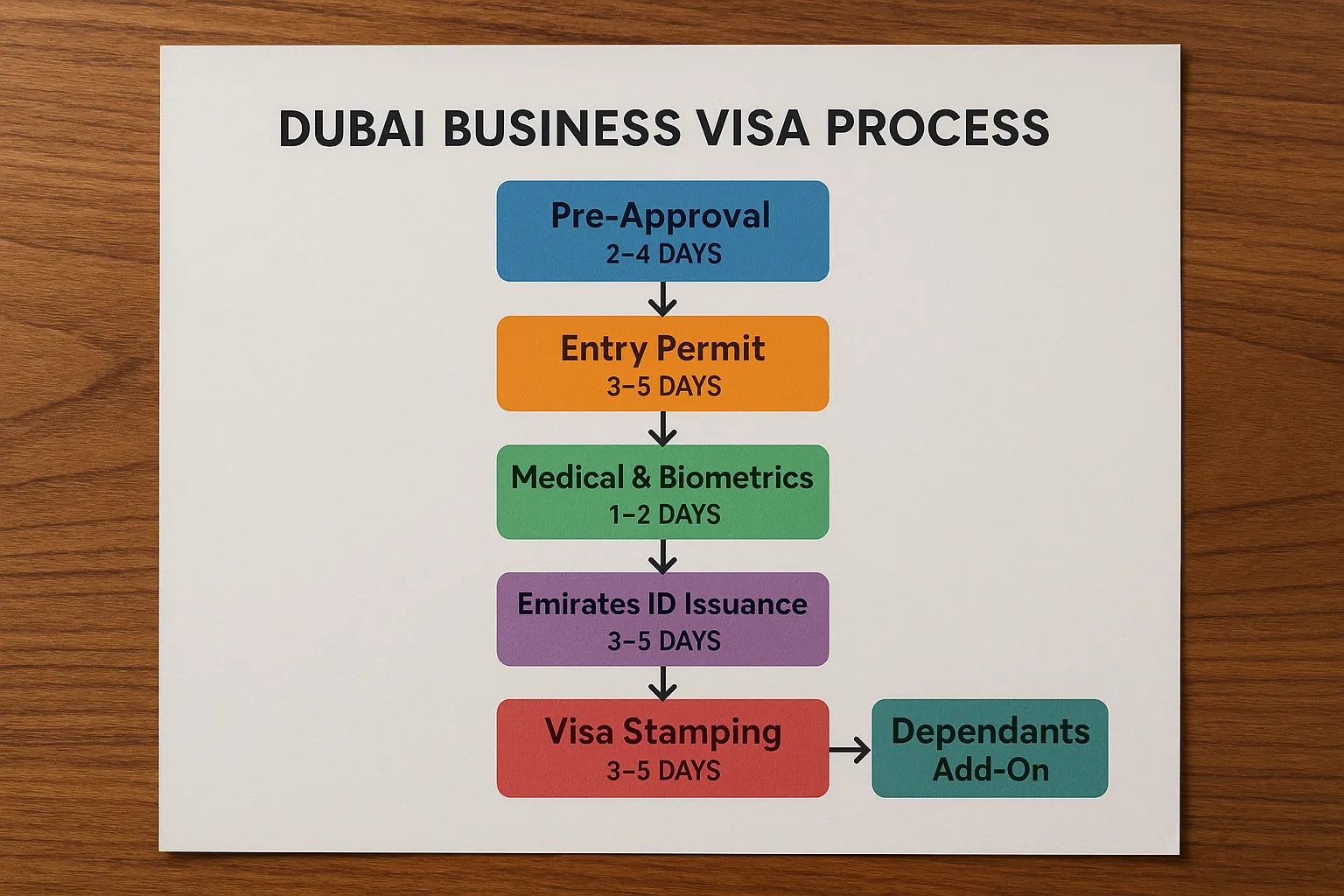

Australians must select a visa type, file company documents for pre-approval, complete medical and biometric checks, and finalize Emirates ID registration before visa stamping in Dubai.

Which type of Dubai business visa is best for Australians in 2025?

Most Australians choose the Free Zone Investor Visa for 100 percent ownership and fast processing. Mainland Investor Visas suit those targeting UAE-based clients and local contracts.

How long does it take to get a Dubai business visa for Australians?

The average Dubai business visa processing time is 11–23 calendar days, depending on whether applicants choose fast-track or regular processing through ICP or free zone authorities.

Can Australians apply for a Dubai business visa online?

Yes. Australians can apply online via approved free zones or the UAE ICP portal. Business setup firms like Dubaiinvest streamline the process with verified digital submissions and compliance checks.

What are the common mistakes Australians make when applying for a Dubai business visa?

Missing attested ATO documents, incorrect passport details, or submitting expired police clearances often cause delays. Working with an experienced consultant helps avoid these pitfalls.