Choosing the right suburb is the single biggest lever you control when you invest in Dubai for the first time. For Aussie buyers, it is also the part that gets oversimplified online, because “Dubai” is not one market. Each neighbourhood has its own tenant profile, supply pipeline, service charges, rental regulations and resale liquidity.

If you are buying remotely from Australia, that complexity multiplies. A great building in the wrong micro-location can underperform for years, while a “boring” area with consistent end-user demand can quietly deliver reliable cash flow.

This guide breaks down the best Dubai areas for Aussie first-time investors, what makes each one work, and the key checks to run before you commit. (And if you want a tailored shortlist, this is exactly what we cover in a consultation with Dubai Invest)

How Aussie first-time investors should choose an area in Dubai

Before we get into specific neighbourhoods, align on the filters that matter most for first-time buyers.

1) Decide your “tenant type” first, not your property type

A lot of Australians start with “studio vs 1 bed vs 2 bed” or “off-plan vs ready.” Start with who will rent this property:

- Young professionals want commute convenience, metro access and lifestyle.

- Families want schools, parks, larger layouts and quieter communities.

- Short-stay guests want tourism demand, building operations that suit holiday lets, and regulation-friendly setup.

When we run consultations, we usually model the tenant type first, then match buildings and streets that fit that demand.

2) Treat service charges as a location problem

Service charges can make a good gross yield look average on a net basis. High-amenity towers and premium communities can carry heavier ongoing costs.

If you have not done this before, read Dubai Invest’s guide on strata fees and service charges in Dubai high-rises and use it as a baseline for your numbers.

3) Liquidity matters more on your first purchase

Your first Dubai investment should usually prioritise:

- Resale demand (more buyers want it, more lenders will finance it)

- Rental demand depth (many tenants, not a narrow niche)

- Building quality you can verify (not just marketing renders)

That is why “established” areas often make sense for first-timers, even if the entry price is higher than emerging districts.

4) Have a finance plan early (cash, mortgage, or developer plan)

Your preferred area can change depending on whether you are:

- Buying cash

- Using a non-resident home loan

- Using an off-plan payment plan

If lending is on the table, start here: non-resident home loans in the UAE for Australians. In a consult, Dubai Invest can also help you sanity-check which buildings and unit types are most lender-friendly.

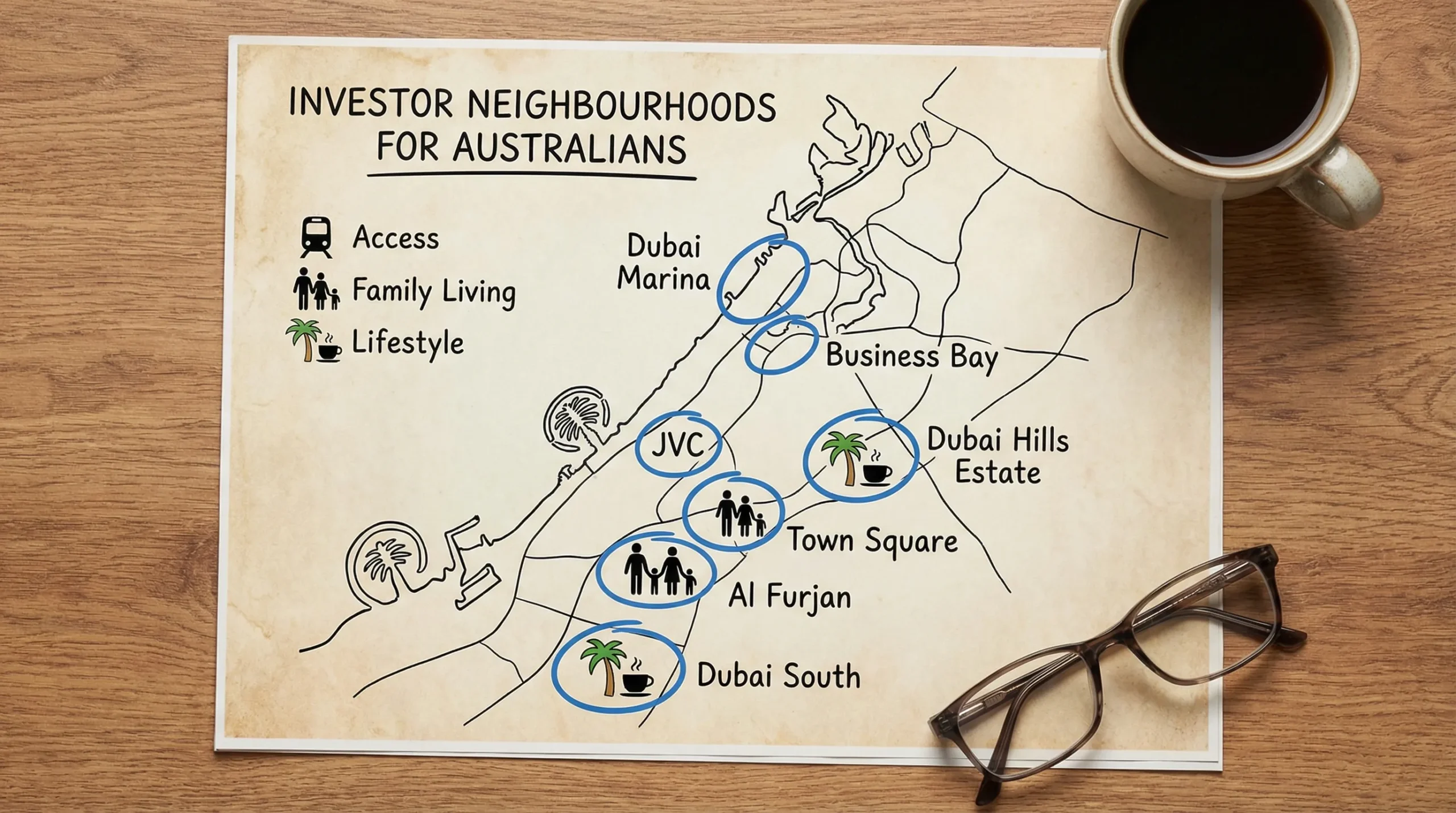

Best Dubai areas for Aussie first-time investors (and why they work)

Below are neighbourhoods that tend to suit first-time international investors because they combine demand depth, recognisable locations, and practical rental and resale dynamics.

Jumeirah Village Circle (JVC): practical entry point with broad tenant demand

JVC remains a common starting point for Australians because it often offers a lower entry price than waterfront or CBD-style locations, while still attracting steady tenant demand.

Why first-timers like it:

- Strong pool of long-term tenants (young professionals and small families)

- A large choice of buildings, which lets you optimise for layout and quality

- Easier to diversify later, because your first unit is not “all-in premium”

What to watch:

JVC is not one uniform product. Two buildings a few minutes apart can perform very differently based on finish quality, parking, access roads, and service-charge efficiency. This is where local due diligence pays off.

Business Bay: central, rental-friendly, and good for liquidity

Business Bay is often attractive for first-time investors who want a central address and a large tenant base connected to the wider city.

Why it works:

- Strong demand from corporate tenants and professionals

- Central positioning supports resale interest

- Good fit for investors considering furnished rentals (depending on building rules and licensing)

What to watch:

Performance varies by tower and by proximity to transport and key corridors. It is also essential to compare building-level service charges and owner rules before assuming short-term letting is viable.

Dubai Marina: established market and globally recognisable location

Dubai Marina is not the cheapest starting point, but it is one of the most recognisable districts for international buyers, which can support liquidity.

Why it works:

- Mature rental market with consistent tenant demand

- Well-known location helps resale visibility

- Lifestyle appeal can support furnished rental strategies (where permitted)

What to watch:

Older towers can differ significantly in maintenance standards and community management. A first-time buyer should be especially careful about building condition, renovation needs, and service-charge impact on net returns.

Dubai Hills Estate: family demand and end-user appeal

Dubai Hills Estate tends to suit Australians aiming for a more “blue-chip family” tenant profile and longer-hold stability.

Why it works:

- Strong lifestyle and community planning, which drives end-user demand

- Family tenant profile can reduce vacancy volatility

- Often easier to position for long-term leasing

What to watch:

The mix of product (apartments vs townhouses vs villas) and sub-community location matters. For first-time investors, the goal is usually to pick a segment with reliable leasing velocity rather than chasing the most premium unit.

Town Square: affordability and family-oriented rentals

Town Square can be attractive for first-time investors who want a family-led community at a more accessible price point.

Why it works:

- Family rental demand tends to be repeatable and practical

- Community-style living can reduce reliance on “tourism demand”

- Often suits investors prioritising steady leasing over prestige

What to watch:

As with many master communities, unit selection matters. Layout efficiency, parking, walkability within the community, and building management standards can affect rental outcomes.

Al Furjan: growing connectivity and a balanced tenant base

Al Furjan is often on the shortlist for investors who want a community feel plus practical connectivity.

Why it works:

- Mix of apartments and villas creates a broader resident profile

- Can suit both professionals and small families

- Often positioned as a “liveable” area rather than purely investor stock

What to watch:

Check the specific building’s access, nearby amenities, and the realistic leasing comps. Also clarify whether your strategy is long-term or furnished, because not every building is equally friendly to short-stay operations.

Dubai South and the Expo City corridor: higher patience, higher “future growth” angle

Dubai South is often discussed as a growth corridor, especially as Dubai’s expansion continues around logistics and Expo-linked development.

Why it can work:

- Potential for longer-term appreciation if infrastructure and demand deepen

- Can suit investors with a multi-year horizon

What to watch:

This is usually not the most forgiving choice for a first-time investor who needs immediate liquidity. If you are considering Dubai South, a consultation should include a clear timeline view, supply pipeline discussion, and a conservative leasing plan.

Quick comparison table (first-timer focused)

Use this as a starting point, then validate building-by-building.

| Dubai area | Best for | Typical first-timer strategy | Key watch-outs |

|---|---|---|---|

| JVC | Value and broad long-term demand | Long-term lease, focus on quality building selection | Big variance between buildings and micro-locations |

| Business Bay | Central professionals and liquidity | Long-term lease or furnished (where permitted) | Service charges and tower rules matter |

| Dubai Marina | Recognisable lifestyle location | Long-term or furnished (building dependent) | Older towers, maintenance, net yield impact |

| Dubai Hills Estate | Family demand and stability | Long-term leasing, longer hold | Segment selection (apartment vs townhouse) |

| Town Square | Affordable family rentals | Long-term lease | Unit layout and community walkability |

| Al Furjan | Balanced tenant base | Long-term lease | Amenity access and realistic comps |

| Dubai South | Longer-horizon growth thesis | Longer hold, conservative lease plan | Liquidity and timing risk |

A practical “area shortlisting” workflow for Australians buying remotely

If you want to reduce decision risk, use a simple workflow before you request inspections, virtual tours, or contracts:

- Define your outcome: cash flow now, growth later, or lifestyle plus investment.

- Pick 2 to 3 areas max: more than that gets messy from Australia.

- Choose buildings, not just suburbs: a great area cannot fix a poor building.

- Stress-test net returns: include service charges, management fees, vacancy allowance, and conservative rent.

- Confirm execution logistics: financing timelines, document handling, and money transfer plan.

Dubai Invest can run this as a structured consult and then turn it into a clear shortlist with next steps. If you are also building a Dubai operating business and need help hiring leadership locally or internationally, an international recruitment agency can be useful for executive-level roles while you focus on the investment and setup pieces.

Why a consultation saves first-time investors real money

Most first-time mistakes are not dramatic. They are small decisions that compound:

- Buying in a building with high service charges that quietly erode net returns

- Selecting an area that does not match your tenant type

- Overestimating furnished rental income without confirming building and licensing practicality

- Underestimating the paperwork and timing realities of buying from Australia

Jomon’s Dubai job and business experience is valuable here because it connects the numbers to reality: how tenants behave, which locations lease smoothly, and what “looks good online” but causes friction after settlement.

Book a consultation and get a tailored Dubai area shortlist

If you want a personalised shortlist of the best Dubai areas for your budget and strategy, book a consultation with Dubai Invest. You will get structured guidance on area selection, building due diligence, finance options (including non-resident lending), documentation handling and end-to-end execution.

Start here: Dubai Invest and request a consultation with Jomon.

Frequently Asked Questions

Why is Dubai attractive for Australian property investors?

Dubai offers high rental yields (6–10%), zero capital gains tax, no annual property tax, strong tenant demand, and investor-friendly ownership laws. For Australians, it’s also a strategic offshore diversification market with a stable currency peg to the USD.

Can Australians legally buy property in Dubai?

Yes.

Australians can buy freehold property in designated areas across Dubai with 100% ownership rights. No local sponsor or residency is required to purchase property.

What are the best Dubai areas for Aussie first-time investors?

Top beginner-friendly areas include:

Dubai Marina – strong rental demand, expat appeal

Jumeirah Village Circle (JVC) – affordable entry prices, high yields

Downtown Dubai – premium capital appreciation

Business Bay – central location, strong tenant pool

Dubai Hills Estate – family-friendly, long-term growth

Damac Hills 2 – lower entry cost, future upside

What is the minimum budget to invest in Dubai property?

Entry-level investment properties typically start from:

AED 600,000–900,000 for studios or 1-bed units in emerging areas

AED 1.2M+ for prime areas like Downtown or Marina

This makes Dubai more accessible than many Australian metro markets.

Do Australians need a UAE residence visa to invest?

No.

You can buy property in Dubai as a non-resident. However, owning property worth AED 750,000+ can make you eligible for a renewable residence visa.