Average Rental Yields by Area in Dubai (2026 Data)

Dubai remains one of the few major global cities where investors can still target strong cash flow without sacrificing liquidity, infrastructure, or tenant demand. But in 2026, “high yield” is no longer a citywide blanket statement, it is micro-market, building, and strategy specific.

This guide breaks down average rental yields by area in Dubai (2026 data) using practical, investor-style underwriting ranges (gross yields) and the on-the-ground factors that push a deal from “looks great on paper” to “performs in real life”. If you’re investing from Australia, the fastest way to avoid yield traps is to book a consultation early, before you commit to a building, a payment plan, or a furnishing strategy. At Dubai Invest, our lead consultant Jomon brings hands-on Dubai business and market experience, so you can stress-test the numbers with someone who understands how deals actually settle and rent.

What Is Rental Yield and Why It Matters for Investors?

Rental yield is the annual rental income a property generates, expressed as a percentage of the property price. It’s one of the quickest ways to compare opportunities across suburbs, property types, and even countries.

Two yield metrics matter:

- Gross yield: Annual rent ÷ purchase price.

- Net yield: (Annual rent minus all costs) ÷ total cash invested.

Most marketing quotes gross yield because it looks higher. Investors should focus on net yield because Dubai’s performance is often decided by service charges, vacancy, leasing fees, and (for short-term rentals) management and platform costs.

If you want to use rental yields in Dubai to make a real decision, you need the yield plus the “why”, tenant profile, likely vacancy, building quality, and what it costs to operate from overseas. That’s exactly what a proper consultation should uncover.

Dubai Rental Market Overview 2026

Dubai’s rental market in 2026 is still supported by the same structural drivers that have mattered since the post-2021 recovery: population growth, job creation across diversified sectors, and continued inflows of international residents.

What has changed for investors is how quickly rents can move by sub-market and unit type. In many communities, tenant demand has become more segmented:

- Smaller, well-laid-out apartments near transport and job hubs tend to lease faster.

- Premium buildings can command higher rents but may not always deliver the best yield because entry prices are higher.

- Secondary buildings in the same area can sometimes outperform on yield if service charges are reasonable and vacancy stays low.

For Australians doing UAE property investment, the key 2026 reality is that “Dubai” is not one market. Yields vary sharply by area, building, and whether your plan is long-term leasing or holiday homes.

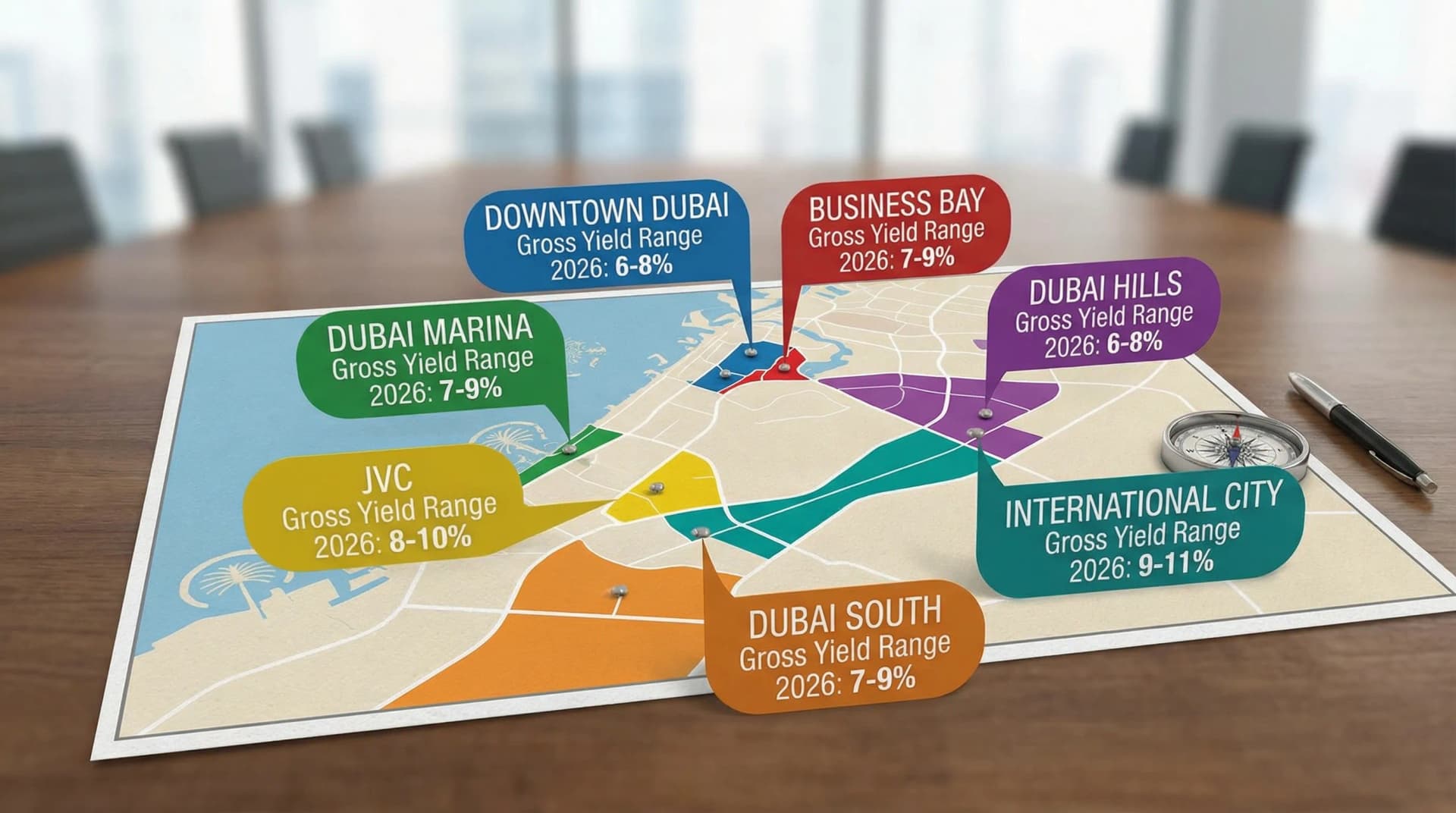

Average Rental Yields by Area in Dubai (2026)

Below is a practical 2026 yield snapshot using indicative gross yield ranges seen in investor underwriting across common freehold areas. These ranges are not an official government publication, they are designed for decision-making and should be verified deal-by-deal.

| Area (Dubai) | Typical investor profile | Indicative gross yield range (2026) |

|---|---|---|

| Downtown Dubai | Prime, corporate, short-stay demand | ~4% to 6% |

| Dubai Marina | Lifestyle tenants, strong leasing depth | ~5% to 7% |

| Business Bay | Mixed corporate and mid-market demand | ~5% to 7% |

| Jumeirah Village Circle (JVC) | Value-driven tenants, high rental depth | ~6% to 9% |

| Arjan | Emerging mid-market, newer stock | ~6% to 8% |

| Dubai Sports City | Budget to mid-market tenants | ~6% to 8% |

| Dubai Silicon Oasis (DSO) | Stable leasing, family and commuter demand | ~6% to 8% |

| Town Square | Family renters, townhome and apartment mix | ~6% to 8% |

| Dubai Hills Estate | Premium family market | ~4.5% to 6.5% |

| Dubai Creek Harbour | Newer premium waterfront product | ~4.5% to 6.5% |

| Dubai South | Infrastructure-led growth, price sensitivity | ~7% to 9% |

| International City | High-yield, higher management intensity | ~7% to 10% |

The phrase average rental yields by area in Dubai (2026 data) should always be read with one caveat: averages hide what matters, which is the exact building, the unit view and layout, current comparable leases, and the true operating costs.

Apartment vs Villa Rental Yields in Dubai (2026)

Apartments typically show higher gross yields than villas because the entry price is lower relative to rent, and the tenant pool is deeper.

In 2026, the most common yield pattern looks like this:

- Studios and 1-beds in mid-market communities often lead on gross yield, but they can be more sensitive to competing supply.

- 2-beds can deliver steadier occupancy and lower turnover in family-friendly buildings.

- Villas and townhouses can offer strong absolute cash flow, but yields are often compressed due to higher prices, plus higher maintenance exposure.

For Australian investors, villas can still make sense if your goals include lifestyle use, long-term capital positioning, or Golden Visa planning. But if the primary target is yield, you usually start underwriting with apartments, then compare villas only when the tenant demand and pricing gap justifies it.

Off-Plan vs Ready Property – Yield Comparison

Off-plan purchases can look attractive because developers may offer lower entry prices and payment plans. The yield question is more nuanced.

For a more detailed comparison of off-plan vs ready-to-move properties in Dubai — especially from an Australian investor perspective , see our guide: Off-Plan vs Ready-to-Move Property in Dubai: A Comparative Guide for Australian Investors.

Ready property advantages (yield-focused):

- Immediate rental income.

- You can inspect the building, assess maintenance, and validate comparable rents.

- Financing is often more straightforward for non-residents on completed stock.

Off-plan advantages (strategy-driven):

- Potentially better basis (purchase price) if you buy early and the sub-market grows.

- Staged cash outlay can improve capital efficiency.

The trade-off is that off-plan yields are delayed, and the “future rent” is an assumption. A consultation should stress-test the completion timeline, post-handover supply, and what the unit will realistically rent for, not what a brochure suggests.

Short-Term Rental Yields (Airbnb) vs Long-Term Rental

Short-term rentals can produce higher gross income in tourist-heavy locations, but net yield depends on occupancy, seasonality, and management.

Long-term leasing tends to win when:

- The building has strong year-round tenant demand.

- You prefer predictable cash flow and lower operational workload.

- You are investing remotely and want lower execution risk.

Short-term rentals tend to win when:

- Your unit is in a prime visitor corridor.

- The building is holiday-home friendly and the unit stands out (layout, view, balcony, parking).

- You can control costs through a strong operator.

A practical tip for short-term landlords: guest demand increasingly includes “pet-friendly stays”. If you’re benchmarking what travellers look for, even resources outside Dubai like curated lists of dog-friendly hotels can be a useful reminder of how amenity filters influence booking conversion.

Factors That Impact Rental Yield in Dubai

Yields in Dubai can swing materially even within the same community. The biggest drivers in 2026 are:

- Service charges (strata-style fees): High charges can wipe out an apparently strong gross yield.

- Vacancy and leasing speed: A 30 to 45 day vacancy period changes your annual return more than most investors expect.

- Unit layout and efficiency: Two units with the same bedroom count can rent differently if one has wasted space.

- Building quality and maintenance: Poor maintenance increases void periods and pushes you toward price-sensitive tenants.

- Furnishing and fit-out (short-term): CapEx can be justified, but it must be amortised correctly.

- Regulatory compliance: Holiday-home licensing and building rules matter if you want short-term income.

- Currency and transfers (AUD to AED): FX timing can change your effective purchase price.

This is why “area yield tables” are a starting point, not a decision. The consultation is where you pressure-test assumptions with current comparables and realistic operating costs.

Highest Rental Yield Areas in Dubai (Top Picks 2026)

If your priority is yield-first real estate investment, these are consistently shortlisted in 2026 underwriting, provided you choose the right building and keep costs controlled:

For a deeper breakdown of specific micro-markets targeting 7%+ returns, see our guide on 8 High-Growth Dubai Neighbourhoods Delivering 7%+ Rental Yields for Australian Property Investors.

- JVC: Depth of tenant demand, wide stock selection, strong rent-to-price relationship.

- Dubai South: Higher-yield potential, more sensitive to project selection and tenant drivers.

- International City (select clusters/buildings): Often high gross yields, but requires tighter management and tenant screening.

- Arjan: Newer buildings, improving amenities, competitive pricing relative to rents.

- Dubai Sports City: Can perform well when you focus on well-managed buildings with reasonable service charges.

The common mistake is buying purely by suburb name. Jomon and the Dubai Invest team typically model yield at the building level, including service charge histories and lease comparables, so you’re not guessing from Australia.

Is Dubai Still a High-Yield Market Compared to Australia?

For many Australians, Dubai still screens as high-yield because gross yields in major Australian capitals are often materially lower, particularly in premium inner-ring suburbs where prices have outpaced rents.

Dubai’s edge in 2026 usually comes from:

- Lower entry prices in many freehold investment districts (relative to rent).

- Strong rental demand across multiple income segments.

- Investor-friendly transaction processes for foreigners in designated areas.

That said, Dubai is not “set and forget” from Sydney or Melbourne. You need to underwrite service charges, vacancy, and management. This is where a consultation pays for itself, by identifying what will hit your net yield before you buy.

How to Calculate Net Rental Yield in Dubai

Use this as a simple framework:

Net yield (%) = (Annual rent minus annual costs) ÷ total cash invested

Typical annual costs to include:

- Service charges

- Property management fees

- Leasing fees (amortised)

- Maintenance and repairs

- Insurance (where applicable)

- Vacancy allowance

- Holiday-home operator fees (short-term)

Example (illustrative only):

If a unit costs AED 1,000,000 all-in (including transfer and setup), rents for AED 80,000/year, and has AED 18,000/year in total running costs and vacancy allowance:

- Net income = AED 62,000

- Net yield = 6.2%

This is why gross yield can be misleading. Two “8% gross yield” deals can deliver very different net outcomes once service charges and vacancy are properly included.

Final Thoughts: Where Should You Invest in 2026?

Dubai can still deliver standout income performance in 2026, but only if you treat the city as dozens of micro-markets, not one headline yield. Start with areas that match your strategy (long-term stability vs short-term optimisation), then underwrite at the building and unit level.

If you want a precise shortlist based on your budget, risk tolerance, and whether you’re buying from Australia with finance, crypto, or a standard transfer, book a consultation with Dubai Invest. Jomon’s Dubai market and business experience helps Australians validate rental yields in Dubai with real comparables, model net returns, and access vetted property listings that fit your goals. Explore Dubai Invest for expert guidance and property listings at dubaiinvest.com.au.

Frequently Asked Questions

What is rental yield and why is it important for Dubai property investors?

Rental yield shows how much rental income a property generates compared to its price, helping investors compare returns across areas and property types.

Which areas in Dubai have the highest rental yields in 2026?

In 2026, areas like International City, Dubai South, Jumeirah Village Circle (JVC), Arjan, and Dubai Sports City often show higher indicative gross yields.

Are rental yields higher for apartments or villas in Dubai?

Apartments generally deliver higher rental yields than villas due to lower entry prices and deeper tenant demand, though villas can make sense for long-term or lifestyle investors.

How does off-plan property impact rental yields compared to ready properties?

Off-plan properties often have lower initial yields because rental income starts after completion, while ready properties can start generating rent immediately.

Can rental yields vary within the same community?

Yes — yields can differ significantly by building quality, service charges, vacancy rates, and unit layouts even within the same area.