From paperwork to perma-records: why blockchain matters now

If you tried to buy a Dubai apartment five years ago, you probably remember PDF contracts flying back and forth, piles of certified copies, and at least one frantic call to a courier in the middle of the night. In 2025, the Dubai Land Department (DLD) has moved most of that friction to the blockchain. Australian buyers can now complete and register a property transfer from the Gold Coast or Perth—often in less time than it used to take to book a flight to DXB.

In this guide we break down, step by step, how blockchain-powered property deals work in Dubai and what you need to do differently (and what you absolutely shouldn’t change) when you’re buying from Australia.

1. How blockchain is reshaping Dubai real estate

Dubai’s government launched the Emirates Blockchain Strategy in 2018 and has spent the past seven years weaving distributed-ledger tech into public services. Real estate became the poster child: today every title deed issued in Dubai is written simultaneously to the DLD’s private blockchain, providing an immutable, easily auditable record.

On top of that foundational layer, a new ecosystem has emerged:

- Smart contracts for sales and leases: Developers such as Emaar and DAMAC now issue pre-approved contract templates that self-execute once both parties’ digital signatures and payment confirmations hit the chain.

- Tokenised property (fractional ownership): Licensed platforms like RealT and local fintech Hoko (regulated by VARA) slice prime assets into legally recognised digital tokens, each representing a share of the freehold.

- Digital escrows: Blockchain escrow services release funds to sellers and commissions to brokers the instant the DLD confirms transfer, eliminating settlement risk.

For Australians, the headline benefit is remote certainty: you can verify the integrity of a title deed, track the progress of a transaction, and see when your name is inscribed in the DLD ledger—without setting foot in an office on Sheikh Zayed Road.

2. Is it actually legal?

Short answer: yes, provided you stick to regulated rails.

- Dubai Land Department blockchain registry – The DLD’s system is not a “shadow” ledger; it is the official registry. Changes recorded on chain have the same legal force as paper deeds.

- Regulated tokenisation – The Virtual Assets Regulatory Authority (VARA) requires any platform that fractionalises property to obtain a Virtual Asset Service Provider licence. Look for that green tick before you invest.

- Cross-border payments – The UAE Central Bank allows property transfers to be settled in AED, USD or in approved stablecoins. Australian buyers must still declare overseas transfers above AU$10,000 to AUSTRAC.

Tip: get your conveyancer to check that the purchase contract references Law No. 7 of 2013 (Dubai Land Department law) and the 2024 Blockchain Implementation Guidelines issued by DLD. That dual reference ensures the court will take the on-chain record as authoritative in the unlikely event of a dispute.

3. Six advantages blockchain delivers to Aussie investors

- Total transparency – Transaction hashes let you verify when funds move from escrow and when the title deed updates.

- Speed – A typical secondary-market apartment now settles in 24-72 hours instead of ten working days.

- Lower costs – Smart contracts automate many broker and trustee tasks, shaving 20–40% off administration fees.

- Remote execution – Biometric eID integration means you can sign and notarise documents with the same myPass UAE app used by residents.

- Fractional entry tickets – With tokenised property, you can own 5% of a downtown studio for as little as AED 50,000 (~AU$20k).

- Enhanced liquidity – Secondary trading of tokens (once the mandatory 6-month lock-up ends) lets you exit without reselling the entire asset.

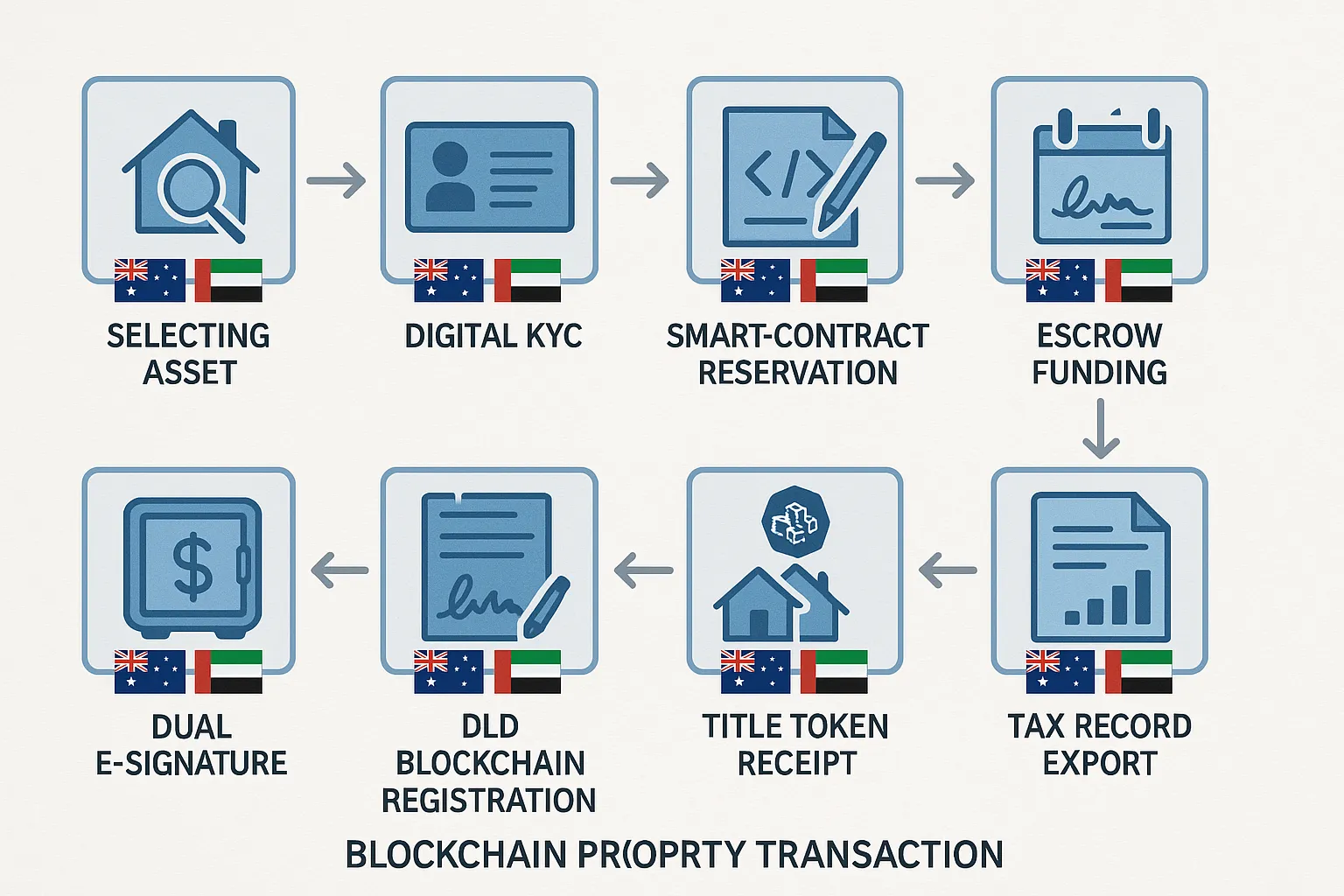

4. A step-by-step checklist for a blockchain-enabled purchase

- Define your structure

- Whole title deed? Use the DLD blockchain registry path.

- Fractional? Choose a VARA-licensed tokenisation platform.

- Engage a blockchain-savvy broker

Dubai Invest maintains partnerships with developers and exchanges already integrated with the smart-contract rails. A single point of contact simplifies due diligence and KYC. - Complete digital KYC & open a UAE digital identity

Your passport and Australian driver’s licence can be verified via the ICP “U-Pass” app. Once validated, you receive a UAE Pass wallet—the key to e-signing. - Reserve the property on chain

The seller (or developer) deploys a smart contract that locks the asset’s token or deed number and spells out milestone payments. - Fund the digital escrow

- Transfer AUD to your multi-currency account (Dubai Invest clients can use our Emirates NBD AUD account to save on FX).

- Convert to AED or approved USDC/USDT stablecoin.

- Send funds to the escrow address generated by the smart contract.

- E-sign & trigger settlement

Both parties sign inside the contract interface. Once the escrow wallet confirms receipt, the smart contract calls the DLD API to request deed transfer. - Receive the on-chain title deed

Within a few minutes you’ll see a new token (ERC-721 on DLD’s private chain) in your wallet and a PDF deed in your email. The PDF contains the transaction hash for third-party verification. - Record for Australian tax purposes

Export the full transaction log (JSON format) in case the ATO requests evidence of purchase cost base and overseas income.

5. Currency, tax and compliance notes for Australians

- Foreign exchange – AUD/AED liquidity has improved since Wise and OFX added dirham corridors in 2024, but blockchain settlement still occurs in AED or USD. Lock your FX rate early.

- Capital Gains Tax (CGT) – Australian residents are taxed on worldwide income, including gains on overseas real estate or tokens. The ATO accepts DLD registry documents and blockchain logs as proof of acquisition date and cost.

- GST equivalent – No GST applies on Dubai property, but remember Dubai’s 4% transfer fee (still payable, though the smart contract can remit it automatically).

- FIRB – The Foreign Investment Review Board does not require approval for offshore purchases. However, if you later repatriate rental income, standard reporting applies.

- Crypto regulations – Holding the property as a token does not make it a “crypto asset” for Australian regulatory purposes if the underlying is real estate. It is treated as an overseas property interest.

For bespoke advice talk to an accountant who understands both the ATO’s crypto guidance (TR 2021/4) and UAE real estate laws.

6. Common pitfalls—and how to avoid them

- Unlicensed token platforms – If a website promises double-digit yields but lacks a VARA licence number, walk away.

- Incomplete KYC – Mismatched passport names or expired proofs of address can lock funds in escrow for weeks.

- Ignoring service charges – Your smart contract may not include the building’s annual service fee. Confirm who pays.

- Wallet security lapses – Treat your UAE Pass credentials like you would your online banking login. Enable hardware 2FA.

- Time-zone mismatches – Settlement can occur within hours; make sure you’re awake (or have a power of attorney) to approve final signatures.

7. Real-world case study

“We bought 12% of a Palm Jumeirah holiday apartment while sipping flat whites in Bondi.” — Olivia & Mark S., NSW

In September 2024, Olivia and Mark allocated AU$180,000 from their self-managed super fund (SMSF) to a fractionalised beachfront unit on Palm Jumeirah listed at AED 4.1 million. Steps taken:

- Signed up on a VARA-licensed platform integrated with the DLD.

- Completed biometric KYC in under 20 minutes.

- Sent AUD to an Emirates NBD AUD account, converted to AED inside the platform.

- Deed tokens landed in their custodial wallet 36 hours later.

- They now collect proportional rent each quarter, auto-converted to AUD.

Key lesson: selecting a platform with direct DLD connectivity removed the need for physical PoA or notary visits.

8. The road ahead: digital dirham & RWA 2.0

The UAE Central Bank is piloting the Digital Dirham (CBDC) this year. Once live, property transactions could settle in native digital AED, eliminating stablecoin conversions and pushing settlement times below ten minutes.

Meanwhile, large developers are experimenting with RWA 2.0 (Real-World Asset) tokenisation, where the deed token also grants voting rights in building management or green retrofits—turning owners into true stakeholders. Expect these features to become mainstream by 2026.

9. How Dubai Invest makes it seamless

Our advisors do the heavy lifting so you can focus on strategy, not admin:

- Pre-vetted property list (whole and fractional) already on the DLD blockchain.

- Preferred FX rates via our Emirates NBD AUD corridor.

- In-house legal team fluent in both UAE blockchain law and Australian tax requirements.

- Post-purchase property management with on-chain rental collection.

Want to meet the experts in person? Join us at the Grand Business Conference later this year—our breakout session on Web3 real estate dives even deeper.

Book a free 30-minute consultation to map your blockchain property journey: Contact Dubai Invest.

10. Quick FAQ

Do I need to open a UAE bank account? No. You can fund escrow from an Australian bank, though having a UAE multi-currency account speeds up rental income transfers.

Can I finance the purchase with an Australian mortgage? Australian banks rarely lend against overseas collateral. Most buyers pay cash or use UAE lenders willing to accept blockchain-registered deeds.

What happens if the smart contract fails? DLD’s blockchain is backed up by traditional legal frameworks. A court can compel the losing party to complete or unwind a transaction.

Can I resell my token on an Australian exchange? Only if that exchange has a reciprocal licence with VARA. Otherwise, list it on the originating platform.

Is my digital deed recognised outside Dubai? Yes, because the PDF deed carries a QR code that any authority can scan to view the blockchain record. While Australian registries won’t integrate directly, they treat it as notarised proof of ownership.

Final take-away

Blockchain doesn’t magically make property cheaper, but it does make good deals faster, safer, and more transparent—especially when you’re buying from 11,000 km away. With the right partners and a clear compliance game plan, Australian investors can harness this technology today to lock in assets in one of the world’s most resilient real-estate markets.

Ready to start? Schedule your call with a Dubai Invest consultant and get your first property deed on chain before the year is out.