“We wanted enough passive income to cover our Sydney mortgage”

Chris and Laura*, both 38, live in Manly and work full-time in marketing and architecture. In late 2023, rising interest rates were squeezing their cash flow. Putting another deposit into Australia’s already pricey market felt risky, so they began looking offshore.

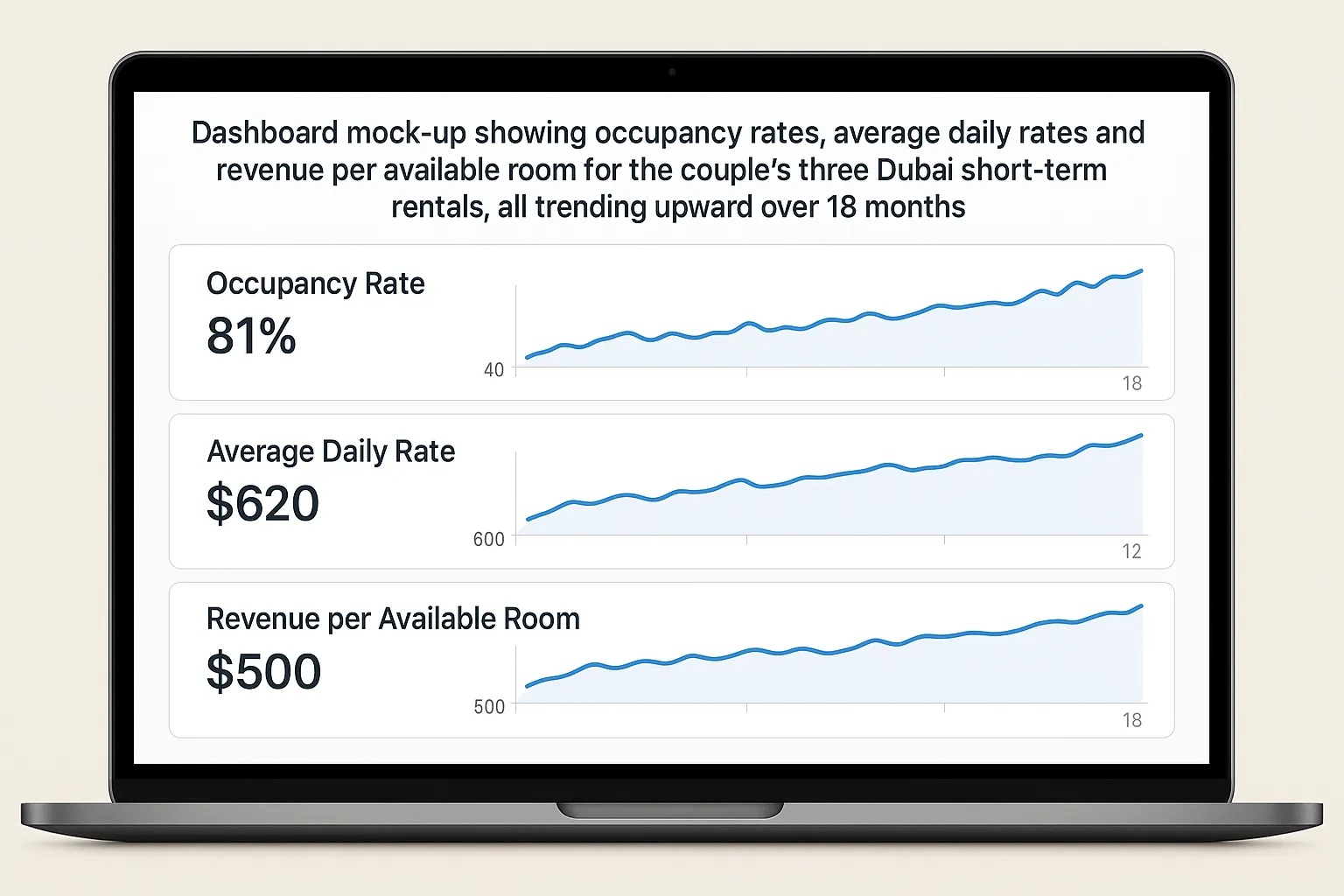

A podcast episode about double-digit returns in the UAE led them to Dubai Invest. Eighteen months later, they own three fully-managed holiday apartments that generate a 9.1 % net yield (after service charges, management fees and tax) – easily beating comparable Australian rentals and diversifying their AUD exposure.

This case study walks through every step they took – from the first Zoom call to the latest quarterly statement – so you can judge whether a Dubai short-term rental strategy belongs in your own portfolio.

*Names changed for privacy.

1. Why Dubai instead of another overseas hotspot?

Chris and Laura compared Portugal’s Golden Visa, Bali villas and US multifamily syndications, but three factors pushed Dubai to the top:

- Higher yields – According to the Dubai Land Department, furnished holiday units averaged 8–11 % net in 2024, versus 3–4 % on Sydney long-term rentals.

- No property tax or stamp duty – Transaction costs hover around 4–5 % all-in, far cheaper than Australia’s 7–10 %.

- A tourism boom with Expo 2020 after-glow – Visitor numbers rebounded to 17 million in 2024 and are on track for 20 million in 2025 (source: Dubai Tourism). Short-letting demand has kept pace.

2. The initial game plan (Month 0–2)

-

Discovery Call (Week 1)

A 45-minute consultation with a Dubai Invest advisor clarified goals (yield over capital gain, minimal day-to-day involvement) and budget (AED 2 million ≈ AUD 830 k). -

Market Deep-Dive (Week 2)

The team supplied recent AirDNA occupancy data, district-by-district ROI tables and a sample cash-flow forecast – essential for aligning expectations with reality. -

Structure & Compliance (Week 4)

• Recommended an LLC in the Dubai Multi Commodities Centre (DMCC) free zone for liability protection and 100 % foreign ownership.

• Arranged a three-year investor visa allowing unlimited stays and a UAE bank account – important for receiving rent in AED. -

Trip to Dubai (Week 6)

Chris flew in for five days to inspect short-listed projects, open the bank account and sign the LLC incorporation documents prepared by Dubai Invest’s legal partner.

Total upfront advisory and government fees: AED 65 400 (≈ AUD 27 k), rolled into the investment budget.

3. Property #1 – A test run in Jumeirah Village Circle

- Purchase price: AED 780 000 (off-plan studio, 41 m²)

- Completion: Q1 2024

- Furnishing & fit-out: AED 45 000

- Airbnb nightly rate (high season): AED 420

- Occupancy (year 1): 82 %

- Net yield (year 1): 8.7 %

Dubai Invest handled snagging, furniture procurement and registration on Dubai’s Holiday Homes portal (DED). Chris and Laura never left Sydney after the initial visit; all updates arrived via a shared Trello board.

4. Scaling to three units (Month 8–18)

Encouraged by steady bookings, the couple refinanced equity from Property #1 and deployed it into two more assets:

| Property | Location | Type | Price (AED) | Completion | Net Yield (yr 1) |

|---|---|---|---|---|---|

| #2 | Dubai Marina | 1-bed (58 m²) | 1 450 000 | Ready | 9.4 % |

| #3 | Business Bay | 2-bed (92 m²) | 2 120 000 | Q4 2024 | 9.0 % (projected) |

Key tactics that kept returns high:

- Flexible finance: Rather than traditional mortgages, Dubai Invest negotiated post-handover payment plans with the developers (40 % during construction, 60 % over two years). This preserved cash flow.

- Dynamic pricing engine: The appointed property manager uses Beyond Pricing to adjust nightly rates automatically – a 17 % revenue uplift vs. fixed pricing.

- Cross-selling extras: Early check-in, airport transfers and desert tours now contribute 6 % of total revenue.

5. Crunching the numbers – portfolio snapshot (May 2025)

- Total capital deployed: AED 4 395 000 (≈ AUD 1.82 million)

- Gross annual rent: AED 600 800

- Operating expenses (incl. management 20 %, utilities, service charges): AED 201 500

- Net operating income: AED 399 300

- Net yield on cost: 9.1 %

Chris and Laura reinvest profits into an offset account against their Sydney mortgage, shaving four years off the loan term.

6. Obstacles (and how they were solved)

- Time-zone coordination – WhatsApp groups with Dubai Invest’s local team ensured questions were answered overnight Sydney time.

- Regulatory updates – A 2024 rule change required extra fire-safety certification. The concierge service arranged inspections and uploaded documents to Dubai Tourism’s e-portal within the two-week grace period.

- Currency exposure – 50 % of net income is converted to AUD quarterly using forward contracts to lock in FX rates; the remainder stays in AED for future purchases.

7. Lessons for Australian investors

- Start with liquidity to spare. Construction progress payments can overlap if you scale quickly.

- Short-term licenses are property-specific. Factor in 600–1 200 AED per year per unit plus a 10 % Dubai Tourism fee on bookings.

- Service charges vary wildly. Older towers in Marina can hit 25 AED/ft² – eroding yield. Newer JVC projects sit around 13–15 AED/ft².

- Local partnerships are non-negotiable. From Ejari registration to DEWA utilities, paperwork is Arabic-heavy. A bilingual team saves weeks.

8. Can you still achieve 9 % in 2025–26?

Yes, but site selection and operator efficiency matter more than ever. Supply is growing: Knight Frank reports 34 000 new holiday-home listings since 2023. Yet destinations near upcoming metro expansions (Dubai Islands, Creek Harbour) show undersupply. Early buyers securing favourable developer terms can still lock in 8–10 % net.

9. A roadmap to replicate the strategy

- Book a feasibility call – In 30 minutes we map out budget, target yield and visa requirements.

👉 Request a call - Receive a personalised market dossier – Heat maps, cash-flow models and side-by-side developer comparisons.

- Choose your structure – Personal title, free-zone company or offshore SPV – we’ll outline pros and cons for tax and lending.

- Fly-in (or stay remote) – We co-ordinate inspections, bank appointments and POA documentation so you can sign in person or via e-signature.

- On-going asset management – Monthly statements, dynamic pricing, guest vetting and maintenance – all under one portal.

“Honestly, it’s been less hands-on than our granny flat in Newcastle.” – Laura

10. FAQ

Do I need to be in Dubai for settlement?

No. A notarised Power of Attorney allows Dubai Invest to sign on your behalf, open the utility accounts and collect keys.

How is rental income taxed for Australian residents?

You declare it in your Australian return; a credit for any UAE withholding applies. The UAE currently levies no income tax on residential rents, so you’re typically taxed at marginal Aussie rates after deductions.

Can I finance with an Australian bank?

Unlikely. Most clients use UAE lenders or developer instalment plans. Loan-to-value ratios for foreigners are 50-60 % on completed units.

What happens if tourism slumps?

Units can pivot to 12-month leases, albeit at lower yields (5–6 %). Stress tests in the couple’s models assumed 60 % occupancy and still cleared 6 % net.

Ready to explore your own Dubai income stream?

Chris and Laura’s story proves Australians don’t need to choose between high returns and lifestyle freedom. With the right guidance, a 9 % net yield portfolio is achievable without relocating – or even leaving your home office.

Book your complimentary strategy session today and let’s map out the first 18 months of your Dubai success story.

Schedule now