Damac Islands Real Estate Investment: Prices, ROI & Buying Guide for 2026

For Australian buyers looking at Dubai’s next wave of master-planned communities, Damac Islands Real Estate Investment is showing up in more 2026 shortlists for a simple reason: it sits at the intersection of lifestyle demand (waterfront-style living) and investor mechanics (developer payment plans, off-plan upside, and strong tenant appetite for new stock). But in 2026, “good project” is not enough, your outcome depends on entry timing, contract terms, service charges, and how you model cash flow in AED while earning in AUD.

This guide breaks down how to assess Damac Islands Real Estate Investment using a practical investor lens: Damac Islands property prices, Dubai property ROI 2026, realistic Dubai rental yields, and the trade-offs in off-plan vs ready property Dubai decisions.

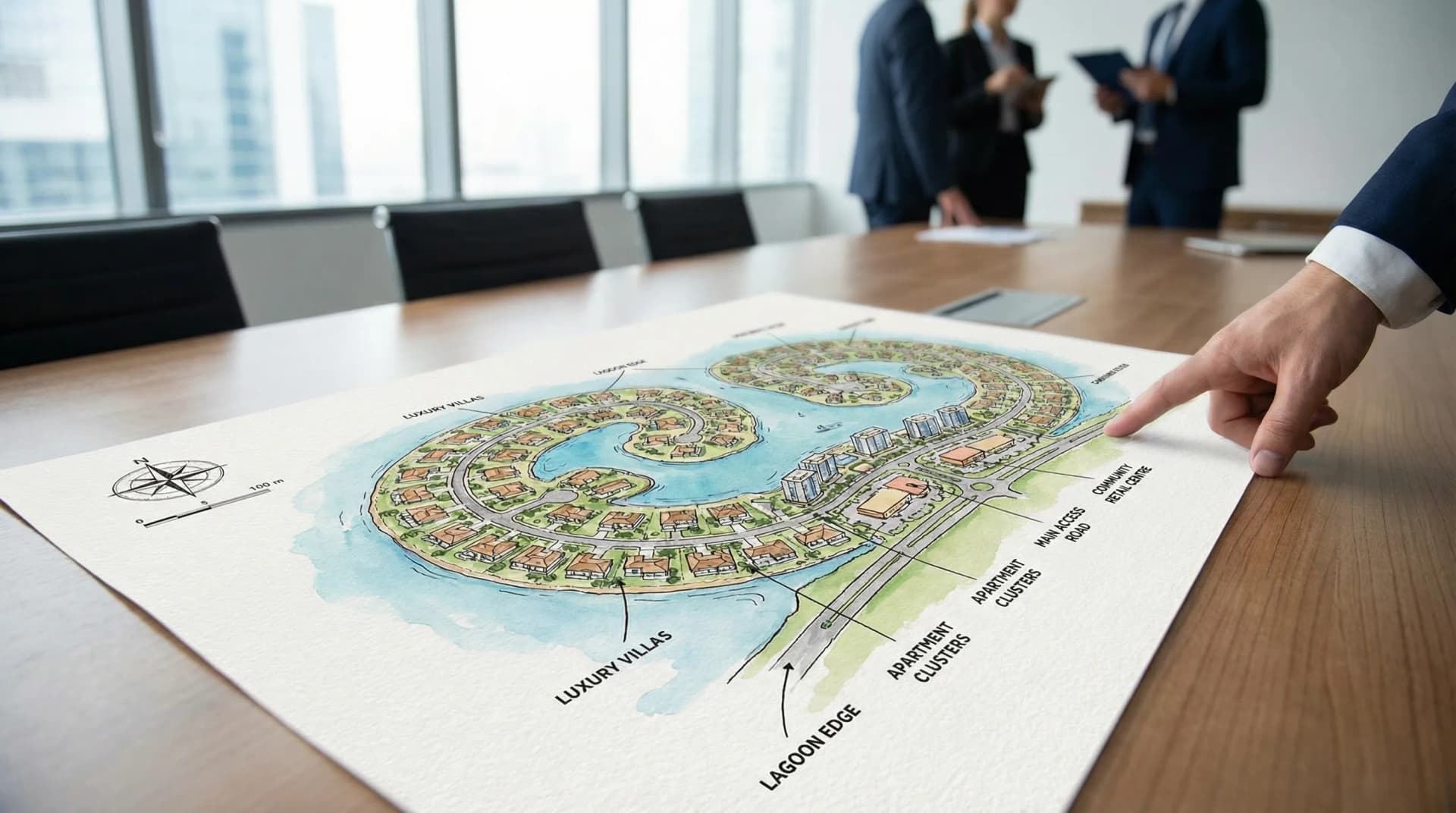

What Are Damac Islands?

At a high level, Damac Islands is marketed as a lifestyle-driven residential destination with a mix of Damac Islands apartments & villas in a planned community format. For investors, the key point is not the brochure, it’s the mechanics: who the end tenant is, what comparable communities are leasing for, and whether the purchase is Dubai freehold property (the usual route for foreign buyers in designated areas).

When you’re underwriting Damac Islands Real Estate Investment, treat the project like a business case:

- Is the unit type aligned with demand (family-sized layouts for villas, executive tenant profiles for larger apartments)?

- Does the community plan support long-term occupancy (retail, access roads, schools, transport links)?

- Do you have a clear strategy for off-plan vs ready property Dubai based on your cash flow and time horizon?

Because developer quality and delivery history matter, it’s also worth understanding the major players before you commit. Dubai Invest can help you compare developers and releases via our developers hub.

Damac Islands Property Prices (2026)

Investors searching for Damac Islands property prices often expect a single number. In reality, Damac Islands property prices move based on release phase, view premiums, plot positioning, unit mix, and payment-plan incentives. In 2026, pricing can also shift quickly when a new release sells out, when comparable communities reprice, or when the developer adjusts the schedule of units offered.

Instead of anchoring on the headline “starting from” figure, evaluate Damac Islands property prices using a like-for-like grid:

| Price driver (what changes the number) | What to check | Why it matters for Dubai property ROI 2026 |

|---|---|---|

| Release phase | Early vs later launch in the same project | Earlier phases can improve upside, but carry more execution risk |

| View and location | Water/lagoon views, corner plots, park frontage | Premiums can be real on resale, but only if demand supports it |

| Size and layout | Sellable area, bedroom mix, storage/maid’s | Drives tenant profile and achievable rent |

| Payment-plan design | Construction-linked vs post-handover | Impacts cash flow timing and IRR |

To keep your pricing assumptions current, follow the broader context in our Dubai real estate trends page. When you book a consult, we can also walk you through current release pricing, comparable resales, and whether Damac Islands Real Estate Investment is priced fairly versus alternatives.

Rental Yields & ROI at Damac Islands

The fastest way to make a mistake in Damac Islands Real Estate Investment is to accept a marketed yield without converting it to a conservative, net view. Your Dubai property ROI 2026 should be built from two components:

- Income return (net rent after service charges, maintenance, leasing fees, and vacancy)

- Growth return (resale gains driven by UAE capital appreciation and market cycles)

In 2026, many Australian investors still start with market-wide Dubai rental yields to sanity-check the opportunity. As a broad benchmark, Dubai rental yields vary by location, building quality, furnishing, and whether you run short-term or long-term leases. That’s why strategy matters, and why we recommend reading our comparison of short-term vs long-term property investment in Dubai.

When modelling Dubai property ROI 2026 for Damac Islands Real Estate Investment, underwrite conservatively:

- Use realistic occupancy assumptions if you plan short-term.

- Stress-test net rent after service charges.

- Use a range for UAE capital appreciation, not a single optimistic number.

A practical tip for Australians: model the FX layer separately. Even if Dubai rental yields look strong in AED, your AUD outcome depends on exchange-rate timing for deposits, instalments, and repatriation.

Payment Plans & Affordability

A core reason Damac Islands Real Estate Investment is attractive in 2026 is affordability through developer payment plans, especially when you compare cash requirements across off-plan vs ready property Dubai.

With off-plan, your cash outlay is typically staged, which can help Australians align payments with savings cycles, equity releases, or planned FX conversions. But staged payments also create obligations you must be able to meet even if the AUD weakens.

When comparing payment plans for Damac Islands Real Estate Investment, pay attention to:

- The milestone schedule (construction-linked vs time-linked)

- Any post-handover component and what “handover” legally means in the SPA

- Default clauses and late-payment penalties

- Whether the plan changes between releases (it often does)

Before signing, use our Dubai off-plan buying checklist to pressure-test the plan against real risks, including delays and service-charge surprises that can dilute Dubai property ROI 2026.

Buying Process: Step-by-Step

The buying journey for Damac Islands Real Estate Investment is straightforward on paper, but it can become expensive if you don’t control the details in the contract and the compliance steps for non-residents.

A clean step-by-step process typically looks like this:

- Strategy and shortlist: confirm target returns, holding period, and whether you want Damac Islands apartments & villas.

- Reserve the unit: pay the reservation and lock the unit details in writing.

- SPA review: check payment milestones, completion definitions, variation rights, and assignment rules.

- Compliance and documentation: passport, proof of address, source-of-funds, and any POA requirements for remote execution.

- Registration: ensure correct off-plan registration and receipts.

- Pre-handover inspections: snagging and defect tracking before final payments.

- Leasing setup: decide on long-term vs short-term and price accordingly to optimise Dubai rental yields.

For the full workflow Australians use to buy remotely, see our step-by-step process for buying property in Dubai.

Financing Options

Financing can materially improve outcomes for Damac Islands Real Estate Investment, but it must match the asset type and the stage of the build. In Dubai, non-resident lending is commonly available for eligible properties, though approval timelines and LTVs can differ between ready stock and off-plan.

For Australians, the decision usually comes down to three levers:

- Use cash and maximise simplicity

- Use a developer plan and manage instalment risk

- Use a bank mortgage (often for completed or near-completion assets)

If you want to explore lending pathways built for Australians, start here: non-resident home loan. In consults, Dubai Invest can also help you align finance with FX planning, so your Dubai property ROI 2026 is not accidentally wiped out by conversion timing.

A note on SMSF Dubai property investing: Australians sometimes ask whether SMSF Dubai property investing is possible for Damac Islands Real Estate Investment. The answer depends on your fund deed, auditor expectations, borrowing rules (LRBA considerations), how the asset is held, and whether the investment meets sole-purpose and arm’s-length requirements. Treat SMSF Dubai property investing as a specialist structuring discussion involving your SMSF accountant and legal adviser, and use Dubai Invest for deal execution support and local coordination.

Risks & Due Diligence

Every offshore purchase has two layers of risk: the property and the process. For Damac Islands Real Estate Investment, the most common risks we see Australians underestimate are:

- Misreading off-plan vs ready property Dubai trade-offs (time-to-income vs price advantage)

- Overstating Dubai rental yields without netting out service charges and vacancy

- Assuming UAE capital appreciation is guaranteed rather than cycle-dependent

- Not validating whether the title path is true Dubai freehold property

- Signing an SPA without independent review, especially around delay and variation clauses

Due diligence is also behavioural. Many investors benefit from reading grounded, first-person perspectives on moving capital and life across borders, not as “market research”, but as expectation setting. A useful example is this personal blog, Raw Life Thoughts, which captures practical reflections from a retired military and law enforcement background.

This is where a consultation pays for itself. Dubai Invest will help you verify the project, interpret contract terms, and model conservative outcomes for Damac Islands Real Estate Investment before you transfer a deposit.

2026 Market Outlook & Expert Predictions

The most defensible thesis for Damac Islands Real Estate Investment in 2026 is not “Dubai always goes up.” It’s that Dubai continues to attract population inflows and global capital, while many buyers still prefer modern communities that support lifestyle and remote work.

For investors, the outlook for Dubai property ROI 2026 is shaped by:

- Supply timing: how much competing stock delivers in the same window

- Tenant demand: household formation, corporate leasing, and short-term tourism demand

- Cost pressures: service charges, insurance, and fit-out costs affecting net Dubai rental yields

- Liquidity: resale depth for specific unit types (especially larger layouts)

If you like the long-term story, underwrite it properly: assume moderate UAE capital appreciation, prioritise unit liquidity, and choose the right strategy in off-plan vs ready property Dubai decisions.

Conclusion & Next Steps

If you’re serious about Damac Islands Real Estate Investment in 2026, treat it like a cross-border project, not an impulse purchase. Confirm current Damac Islands property prices, model Dubai property ROI 2026 using net assumptions, sanity-check Dubai rental yields, and pick the right path between off-plan vs ready property Dubai.

Most importantly, get deal-specific advice. Dubai Invest exists to help Australians invest smart and set up seamlessly, including end-to-end support across shortlisting, documentation, finance pathways, and remote execution. Our lead consultant Jomon Ulahannan brings both job experience and business experience in Dubai, which helps Australian investors avoid the small contract and process mistakes that can cost real money.

When you’re ready, book a strategy session and request current listings and release sheets via our consultation page: book a consultation.

Frequently Asked Questions

What ROI can investors expect from Damac Islands?

Projected rental yields in emerging villa communities like Damac Islands range between 6%–8% annually, depending on unit size, location within the master community, and rental demand. Capital appreciation potential is stronger during early off-plan phases.

Is Damac Islands a good investment for Australian buyers?

Yes, Damac Islands appeals to Australian investors due to:

-

Tax-free rental income in the UAE

-

Flexible post-handover payment plans

-

Strong villa demand in Dubai

-

Potential Golden Visa eligibility (for qualifying property values)

However, investors should evaluate cash flow timing and market cycles.

What is the starting price for properties in Damac Islands in 2026?

In 2026, Damac Islands villa prices are expected to start from approximately AED 2.2M–2.5M for 4-bedroom units, depending on phase release and payment plan structure. Waterfront and larger villas typically command higher prices.

What payment plans are available for Damac Islands?

Developers typically offer structured payment plans such as:

-

60/40 or 70/30 (during construction / on handover)

-

Post-handover payment options (select phases)

-

10%–20% booking amount

Exact plans depend on the launch phase.

Is Damac Islands better for capital growth or rental income?

Damac Islands is primarily positioned as a capital appreciation play during early launch phases, with rental income potential increasing closer to handover as villa demand strengthens.