Why Dubai Free Zones Matter for Aussie Online Entrepreneurs

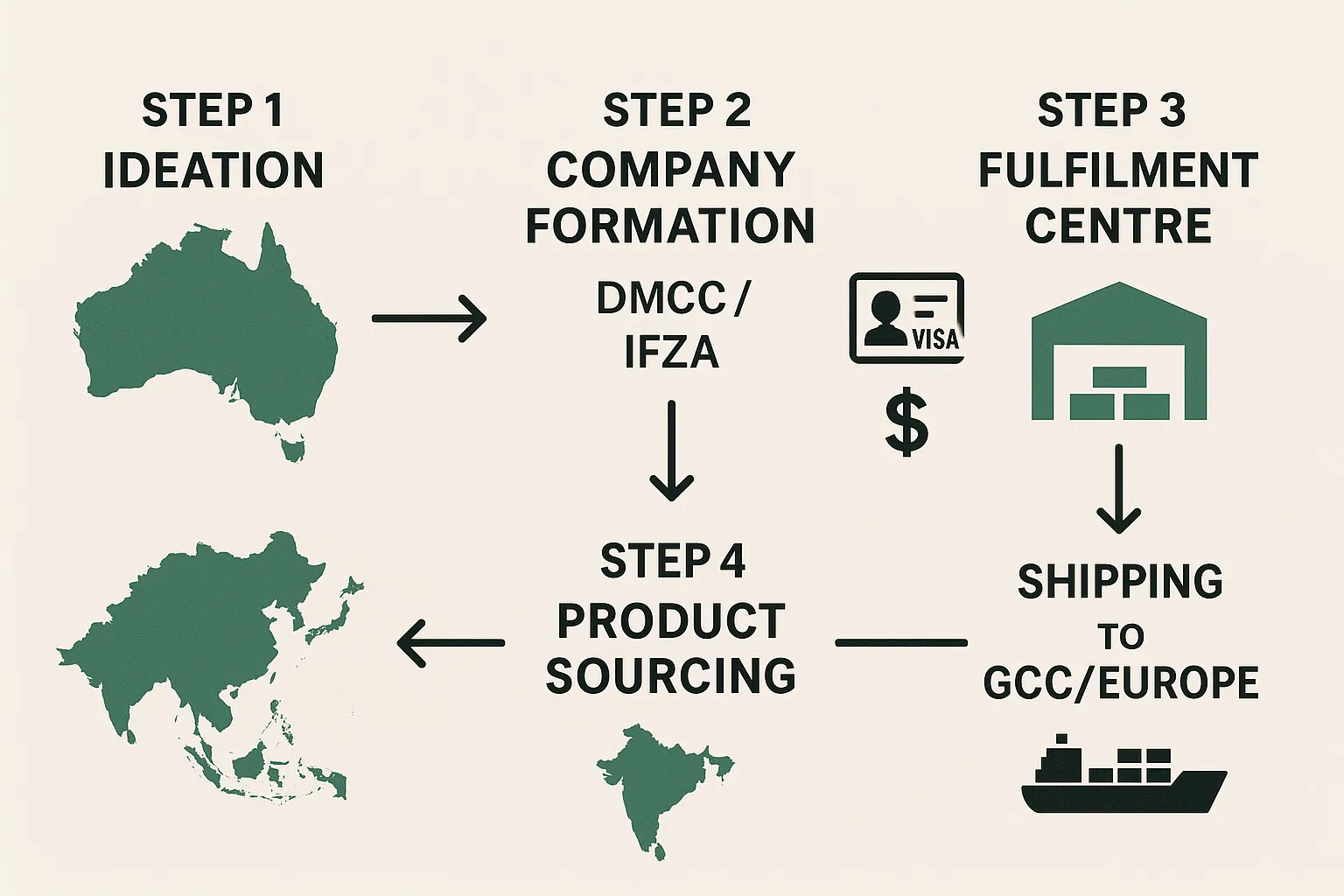

More Australians than ever are tapping into Dubai’s strategic location, zero-tax regime, and hyper-connected logistics network to scale their e-commerce brands into Europe, the Middle East and Africa. Free zones are the entry point: they let you own 100% of your company, repatriate profits freely and fast-track your residence visa.

Two authorities dominate the conversation in 2025 when the business model is “online store first, warehouse later”:

- DMCC (Dubai Multi Commodities Centre) in Jumeirah Lakes Towers, and

- IFZA (International Free Zone Authority) in Dubai Silicon Oasis.

Each promises seamless setup, but the fine print differs. Below is a head-to-head guide designed specifically for Australian founders deciding where to park their next Shopify, Amazon FBA or DTC venture.

![]()

1. Licence Categories & What They Cover

| Free zone | Popular e-commerce licence | Add-on activities | Typical Australian use case |

|---|---|---|---|

| DMCC | Trading Licence – e-commerce | Import/Export, Warehousing, Consultancy | Amazon FBA seller shipping to GCC & EU |

| IFZA | Professional Licence – Online Marketplace Activities | Logistics, Marketing, Technology Services | Niche Shopify brand outsourcing fulfilment |

Key takeaway: Both accept pure e-commerce activities, but DMCC lets you bolt on commodities or precious-metals trading later without relocating. If you foresee evolving into distribution or wholesale, DMCC offers more breathing room.

2. Setup Timeline & Paperwork

- IFZA: 5–7 working days once KYC is approved. Passports and a simple business plan are enough; physical presence in Dubai is optional until you need the visa stamped.

- DMCC: 10–14 working days because the authority runs its own background screening and requires a signed lease (Flexi-desk or office) before licence issuance.

For founders still finalising suppliers, the speed of IFZA can mean launching while you’re still in Melbourne testing ads.

3. Cost Comparison (2025 Fees)

| Item | DMCC Year 1 (AED) | IFZA Year 1 (AED) |

|---|---|---|

| Incorporation package (1 visa quota, flexi-desk) | 50,500 | 36,900 |

| Additional shareholder | 1,840 | 0 (included) |

| Mandatory health insurance (per visa) | 2,000–3,500 | 2,000–3,500 |

| Renewal from Year 2 | 30,000–32,000 | 18,000–20,000 |

Exchange rate at July 2025: 1 AUD ≈ 2.46 AED.

Budget tip: IFZA’s lower annual overheads appeal if your store is pre-revenue or still validating product-market fit.

4. Office & Warehouse Options

- DMCC ties you to the JLT cluster – great cafés, Dubai Metro access, premium address. Flexi-desks are limited; you usually upgrade to a serviced office (10–15 m²) by Year 2.

- IFZA allows “virtual office” for the life of the licence. When you outgrow that, you can lease third-party warehouses in mainland Dubai without changing authority.

Australian sellers using 3PLs like Emirates Logistics or RSA Global find IFZA’s flexibility more forgiving because the fulfilment centre can sit anywhere in the city.

5. Banking & Payment Gateway Openings

• DMCC companies are often viewed as blue-chip by Emirates NBD, Mashreq and international banks. Getting multi-currency accounts (AUD, USD, AED, EUR) is smoother.

• IFZA companies usually start with digital banks (Wio, Zand). Traditional banks may ask for higher minimum balances (AED 300,000+).

If you plan hefty ad-spend in AUD and USD, DMCC’s banking edge can save on FX fees.

6. Customs & Last-Mile Logistics

- E-Channels integration: DMCC connects directly to Dubai Customs, so import codes for each SKU are generated in-house.

- IFZA requires a third-party clearing agent but compensates with partnerships like Aramex Shop & Ship offering discounted cross-border rates.

For Amazon AE or Noon sellers, both free zones qualify you for seller-fulfilled prime; warehouse location matters more than licence location.

7. Visa Quotas & Family Sponsorship

| Visa allocation | DMCC | IFZA |

|---|---|---|

| Base package | 1–3 visas | 1 visa |

| Extra visas | Add desk space | Pay fee (4,500 AED) without extra office |

| Spouse & kids sponsorship | Yes | Yes |

Families relocating from Sydney appreciate DMCC’s kids-club-rich neighbourhoods (clusters Q-T), yet IFZA’s distance from beach hotspots can be offset by lower rent in Silicon Oasis or Mirdif.

8. Compliance & Reputation

- DMCC is ISO 9001 certified, governed by Dubai Executive Council and has ranked the world’s No.1 free zone (Financial Times fDi) nine years running.

- IFZA is younger (est. 2018) but has signed MoUs with Emirates Development Bank and Etisalat to digitalise SME onboarding.

When pitching B2B clients or investors, a DMCC company on your cap table can boost perceived legitimacy. For purely consumer-facing DTC brands, customers rarely notice the backend.

9. Sustainability & Impact (Rising Investor Concern)

DMCC’s “JLT Sustainability Committee” enforces green building codes; membership scores you points with ESG-minded funds. IFZA is catching up with a newly launched carbon-offset programme for SMEs declared in Q2 2025.

10. Exit Strategy: Selling the Business

Australians dreaming of a future acquisition should note:

- Share transfer in DMCC takes 3–4 weeks including NOC from the authority, buyer due diligence and updated MoA.

- IFZA share transfer is faster (1–2 weeks) and cheaper (~5,000 AED vs 9,500 AED).

Marketplace aggregators like Perch or Thrasio operating in Dubai are already familiar with both frameworks, but quote slightly higher multiples for DMCC entities.

Quick Decision Matrix

Answer these three questions honestly:

- Is prestige crucial for high-ticket B2B partnerships or VC funding?

- Yes ➜ DMCC

- No ➜ continue

- Do you need to watch every dollar until sales hit A$20k/month?

- Yes ➜ IFZA

- No ➜ continue

- Will you require commodity, crypto or precious-metals trading later?

- Yes ➜ DMCC

- No ➜ IFZA (or either)

If you circled DMCC more than once, the premium is justified. Otherwise, IFZA gives you a lean start.

How Dubai Invest Can Help

Selecting a free zone is only the first kilometre of a marathon that involves:

- Bank account approvals and FX optimisation for AUD flows

- Payment gateway integration with Telr, PayTabs or Stripe Atlas

- Last-mile contracts with Aramex, Shipa, or Amazon FBA UAE

- Quarterly VAT filing—yes, you must register once turnover hits AED 375,000

Our Australia-based consultants and Dubai on-ground corporate admins manage the entire journey remotely or in person. We’ll draft the application, attend notarisation, and courier your documents so you never miss a beat.

Ready to dive deeper? Secure a 30-minute strategy call or meet us at the Grand Business Conference in September 2025 for live case studies from fellow Aussie founders who scaled from kitchen table to seven figures offshore.

Bottom line:

- Bootstrapped e-commerce? Choose IFZA for speed and savings.

- Brand with global ambitions and investor radar? DMCC wins on credibility and banking muscle.

Whichever path you pick, the UAE’s zero-corporate-tax e-commerce playground is open—and Dubai Invest makes sure the setup is as smooth as express shipping to Perth.