Dubai keeps evolving fast, and that’s exactly why many Australians are looking beyond the “usual” postcodes and into the next wave of neighbourhoods that can outperform over a full property cycle. In 2026, the smartest opportunities are often found where infrastructure, job hubs, and master planned communities are converging, but where pricing is still catching up to the long-term vision.

This guide breaks down the emerging property hotspots in Dubai for 2026 that Australian investors should have on their radar, plus how to assess risk and move forward confidently. If you want a shortlist that matches your budget, yield target, and visa goals, a consultation is the quickest way to avoid expensive missteps, especially if you’re buying remotely.

Why Dubai Remains a Top Choice for Australian Investors

Dubai’s real estate market momentum in 2026 is being underpinned by a combination of population growth, long-term government planning, and a mature property transaction system that has become increasingly friendly to foreign buyers. For Australians, the appeal isn’t just lifestyle, it’s the ability to build a globally diversified asset base in a market that can offer strong rental demand across multiple segments.

A key drawcard is the tax profile. The UAE does not levy personal income tax in the way Australians are used to, and there is no annual property tax in the same format as many other global cities (Australian investors should still plan for ATO reporting and Australian tax treatment). When you combine this with Dubai’s rental culture, professional property management ecosystem, and clear freehold zones for foreigners, UAE property investment becomes a realistic and scalable strategy, not just a “holiday home dream”.

Finally, demand is increasingly spreading into emerging areas. As transport links expand and new commercial clusters form, tenant demand follows, first for affordability and convenience, then for lifestyle. That shift is what creates the next set of hotspots.

What Makes a Property Hotspot in Dubai?

A “hotspot” is rarely about a single building or a short-lived marketing campaign. It’s typically the result of multiple value drivers stacking together over time.

1) Infrastructure and connectivity: New roads, metro extensions, airport access, and better last-mile connectivity can meaningfully widen the tenant pool. Areas that reduce commute friction tend to show stronger occupancy and rent resilience.

2) Masterplans that create self-contained demand: Dubai’s best-performing districts are usually masterplanned, meaning you’re not only buying a unit, you’re buying into schools, retail, green space, walkability, and long-term maintenance standards.

3) Job hubs and logistics corridors: Where employment concentrates, rental demand strengthens. Logistics, aviation, tech, healthcare, and finance clusters influence which districts win.

4) Upcoming projects that reset perceptions: Major waterfront phases, retail expansions, parks, and new bridges can change a location’s “mental map” for tenants and end-users.

5) Government initiatives that support foreign participation: Freehold ownership frameworks, regulated brokerage, and residency pathways (including long-term visas linked to qualifying investments) help sustain international demand. For process clarity, it’s worth reviewing Dubai Land Department information via the Dubai Land Department portal and then validating your plan with a local advisor.

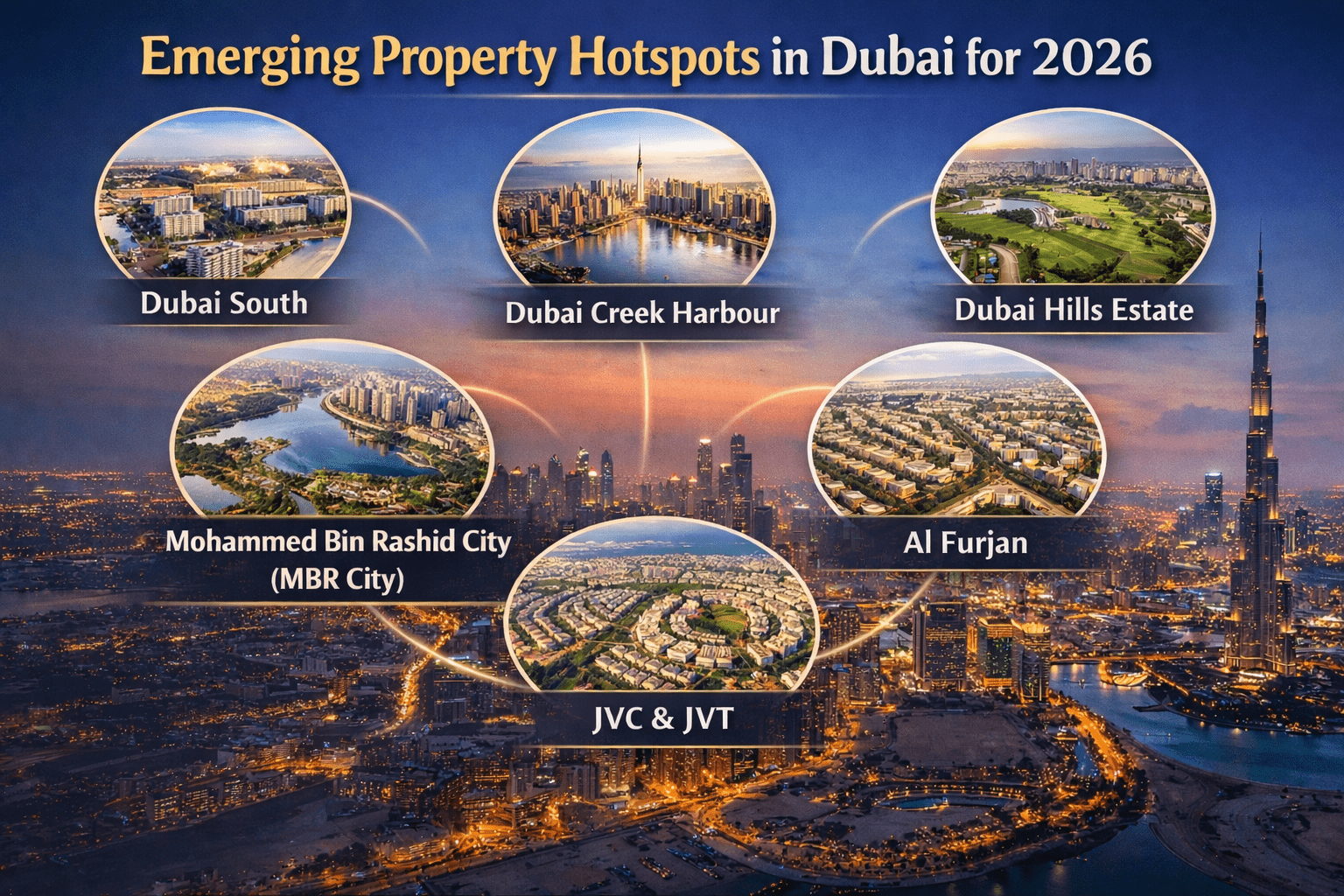

Top Emerging Property Hotspots in Dubai for 2026

Dubai South – Proximity to Expo 2020 legacy projects, airport, and logistic hubs

Dubai South continues to mature as a long-horizon play built around aviation, logistics, and the broader Expo City legacy. For investors, the logic is straightforward: employment nodes create tenants. With proximity to Al Maktoum International Airport and large-scale logistics activity, Dubai South can suit buyers targeting workforce rentals, value-oriented end users, and medium-term capital growth as the district becomes more “lived in”.

The key due diligence angle here is micro-location and delivery sequencing. Some pockets benefit earlier from retail, schools, and transport upgrades, while others may take longer to feel like a complete community. Off-plan stock can be attractive, but Australians should stress-test completion timing, service-charge assumptions, and realistic rent-on-handover scenarios.

Dubai Creek Harbour – Waterfront developments and luxury mixed-use projects

Dubai Creek Harbour sits in a different lane: waterfront lifestyle, skyline views, and a premium positioning that can pull both end-users and higher-income tenants. What makes it “emerging” in 2026 is the ongoing nature of the masterplan and the continued roll-out of community infrastructure that increases liveability.

For Australian investors, the opportunity is often in selecting the right building within the broader district. Two towers in the same area can perform very differently based on view corridors, retail access, parking, and future construction impact. If your strategy is capital growth plus quality tenants, Creek Harbour can be a strong contender, but only when building-level analysis matches the story.

Dubai Hills Estate – Family-friendly community with premium facilities

Dubai Hills Estate has been popular for a while, but it remains “emerging” in an investor sense because it’s still consolidating into a mature, high-liquidity community with strong family demand. Families rent differently: they typically stay longer, prioritise schools and parks, and accept slightly higher rents for stability.

In 2026, Dubai Hills can suit Australians aiming for a lower-drama investment experience, particularly in well-managed apartment buildings near retail and green space, or in selected villa and townhouse pockets where tenant demand is deep. The trade-off is entry price: you’re buying quality, so you need to ensure your net yield expectations align with service charges and maintenance realities.

Mohammed Bin Rashid City (MBR City) – High-end villas, urban lifestyle, and retail hubs

MBR City is one of the clearest examples of a masterplan that targets an affluent tenant and buyer base. The appeal is a premium lifestyle close to central Dubai, with modern villas, upscale apartments, and a strong “new Dubai” feel.

For Australian investors, MBR City can work well for capital appreciation strategies, particularly where supply is controlled and the product is differentiated. The risk is overpaying for a story without modelling real comparables. In high-end districts, a small pricing error can take years to unwind. This is where an on-ground advisor becomes valuable, not to “sell” a project, but to verify what actually rents, what resells, and which developer communities hold value.

Jumeirah Village Circle (JVC) & Jumeirah Village Triangle (JVT) – Affordable options with strong rental demand

JVC and JVT remain among the most discussed areas for Australians because they often sit in the sweet spot of affordability and tenant demand. In 2026, these communities continue to benefit from a large renter base seeking practical locations, modern layouts, and access to key employment corridors.

The investor challenge is that performance is building-specific. Two-bedroom layouts, parking, maintenance standards, and service-charge levels can materially change net returns. If you’re chasing yield, JVC in particular can look compelling, but only if you avoid older stock with poor upkeep or unrealistic “headline” yield claims.

Al Furjan – Connectivity and emerging mid-market villas/apartments

Al Furjan is increasingly viewed as a balanced play: family-friendly, well-connected, and positioned for steady demand rather than hype-driven spikes. Its appeal is often strongest for mid-market villas, townhouses, and practical apartments that serve long-term residents.

In 2026, Al Furjan can work well for Australians who want a stable tenant profile and prefer areas that feel like real neighbourhoods. As always, the micro-market matters. Proximity to transport, retail, and community facilities tends to show up directly in rentability and vacancy outcomes.

| Area | Primary demand driver | Typical investor fit | What to verify before buying |

|---|---|---|---|

| Dubai South | Logistics, aviation, Expo legacy | Long-horizon growth, value rentals | Delivery sequencing, true rent-on-handover |

| Dubai Creek Harbour | Waterfront lifestyle, premium positioning | Quality tenants, capital growth | View corridors, construction impact, building premiums |

| Dubai Hills Estate | Family demand, premium amenities | Stability-focused portfolios | Net yield after service charges, building management |

| MBR City | High-end lifestyle, proximity to central Dubai | Capital appreciation strategies | Comparable sales, exit liquidity, community maturity |

| JVC/JVT | Large renter base, affordability | Yield-seeking investors | Building quality, service charges, unit layout popularity |

| Al Furjan | Connectivity, family living | Balanced yield and stability | Access, transport proximity, villa/apartment mix |

Investment Potential of These Hotspots

Most Australian buyers ask two questions first: “What can it rent for?” and “Will it grow in value?” The honest answer is that both depend on execution, not just suburb selection.

In many parts of Dubai, investors often target mid-to-high single-digit gross yields, but net yield can drop meaningfully once you include service charges, maintenance, letting fees, vacancy, and currency transfer costs. Capital appreciation is also highly cycle-dependent, and tends to reward investors who buy into infrastructure and liveability before it is fully priced in.

Two practical rules for 2026 hotspot investing:

- Apartments often outperform on liquidity and rentability in tenant-heavy districts (for example JVC or parts of Dubai South), especially when unit sizes and layouts match what renters actually want.

- Villas and townhouses can outperform on scarcity in family-led communities (for example Dubai Hills or Al Furjan), but require higher capital outlay and stronger asset-management discipline.

Risk assessment and timing tips that matter for Australians:

- Model returns in AED and AUD, including an FX buffer, particularly if you’re funding from Australia.

- Check service charges early, they are one of the biggest drivers of net performance.

- If buying off-plan, validate escrow, developer track record, and realistic handover windows.

This is why many clients start with a consultation: it’s the fastest way to translate “hotspot headlines” into an investable shortlist aligned with your risk tolerance.

How Australian Investors Can Get Started

Australian investors can buy in Dubai, including remotely, but the process has moving parts that can derail timelines if you don’t plan upfront.

Legal requirements and visa considerations: You do not need a UAE residency visa to purchase property, but visa strategy can influence your buying plan (for example, if you want longer stays, banking convenience, or long-term residency pathways tied to qualifying investments).

Financing options available for foreigners: Non-resident mortgages exist, but approval speed and documentation requirements vary by lender and property type. Many Australians also compare developer payment plans vs bank lending, depending on cash flow and risk appetite.

Practical execution (especially remotely): The real work is aligning due diligence, contracts, KYC, currency transfers, and handover management. Investing offshore can be intense, so staying mentally and physically balanced is underrated. Some investors build routines around sleep, stress control, and decision quality using resources on holistic approaches as a complement to the financial work.

Role of property advisory services like DubaiInvest: Dubai Invest supports Australians with end-to-end execution, from area selection to document handling and on-ground coordination, so you can invest without flying back and forth.

Why Partnering with DubaiInvest Makes a Difference

Hotspots are only half the story. Results come from selecting the right building, negotiating effectively, validating fees, and planning for finance, FX, and management.

DubaiInvest.com.au exists specifically to help Australians invest with clarity. Your strategy call is not a generic “sales chat”, it’s designed to:

- Translate your goals into a location and property-type brief

- Pressure-test expected rent, vacancy assumptions, and ongoing costs

- Flag legal, finance, visa, and documentation considerations early

Dubai Invest’s principal consultant, Jomon, brings both professional and business experience in Dubai – an advantage when decisions require real-world insight rather than brochure claims. His on-ground perspective helps clients assess how projects perform in practice, including build quality at handover, tenant behaviour, and long-term resale liquidity.