Introduction – Why a Clear Exit Plan Matters

Experienced investors know that the real return on a property is only locked in once you have exited at the right price and successfully moved the proceeds home. For Australians who bought during Dubai’s 2020–23 boom, selling property in Dubai as a non-resident can feel daunting: different laws, unfamiliar paperwork, and foreign-exchange controls all need to line up. A well-designed exit strategy not only safeguards profit but also shortens the time your capital sits idle between opportunities.

Understanding Non-Resident Property Sales in Dubai

Dubai welcomes foreign sellers, yet there are specific rules that differ from Australian conveyancing:

- Freehold vs leasehold: Only freehold owners in designated areas can sell without special approvals. Check your title deed before listing.

- NOC (No-Objection Certificate): Issued by the developer or the Owners Association confirming service charges are paid. No NOC, no transfer.

- RERA-approved brokers: Non-residents must appoint a broker with an active “BRN” to list legally. Selling privately is possible but limits market reach.

- Power of Attorney: If you cannot fly to Dubai for transfer, a notarised and UAE-attested POA enables a representative to sign contracts and collect cheques on your behalf.

Pro tip: Build POA into your planning six to eight weeks before marketing the unit; UAE attestation can add 10–15 business days if handled from Australia.

Step-by-Step Process to Sell Your Property

- Pre-sale health check (Week 0–1)

- Retrieve title deed (Digital Deed via Dubai REST app).

- Order a service-charge statement and snag report if the unit is tenanted.

- Price discovery (Week 1)

- Ask two RERA brokers for recent transfers and rental income comparisons.

- Factor in any currency view on AUD–AED.

- Broker appointment & photography (Week 1–2)

- Sign form A, the official listing agreement.

- High-resolution photos and 360-degree tours boost visibility on Property Finder and Bayut.

- Marketing & viewings (Week 2–6)

- Typical marketing cycles run 30–45 days in mainstream communities.

- Ensure tenant access is agreed; Dubai gives tenants 2 weeks’ notice for viewings.

- Accepting an offer (Week 4–6)

- Sign Memorandum of Understanding (Form F) and collect 10% security cheque from buyer.

- Apply for NOC immediately; most developers take 5–7 business days.

- Transfer at DLD Trustee Office (Week 6–8)

- Buyer pays 4% transfer fee plus trustee fee (AED 4,000).

- Seller receives manager’s cheque or same-day bank transfer.

- Mortgage settlement & utility closures (Week 8)

- If the property is mortgaged, bank issues a liability letter (up to 10 days) and arranges clearance.

Repatriating Funds Safely to Australia

Once the manager’s cheque clears in your UAE account, the next hurdle is moving funds to an AUD account with minimal slippage and full compliance.

| Task | Typical Time | Key Documents |

|---|---|---|

| Deposit cheque & clear funds | 1–2 business days | Sale contract, passport copy |

| FX conversion AED→AUD | Same day (spot) or up to 2 days (forward) | Bank or broker KYC, source-of-funds letter |

| International wire to Australia | 1–2 business days | Purpose code (Central Bank), AU beneficiary details |

Guidelines to minimise friction:

- Use a multi-currency account in Dubai to avoid double spreads. Convert once, not twice.

- Shop FX providers: Specialist brokers often beat bank rates by 0.5–1.2 percent.*

- Declare capital gains in the relevant Australian tax year. The 2024 Australia–UAE tax treaty allows a Foreign Income Tax Offset if Dubai corporate tax applied (rare on residential units).

*Source: CompareForexBrokers June 2025 survey of retail AED–AUD spreads.

Compliance checklist for Australians

- AUSTRAC TTR form if cash exceeds AUD 10,000 (banks handle automatically).

- Retain sale contracts and DLD receipts for at least five years to prove cost base to the ATO.

- If you sold via a UAE company, apply Australia’s CFC rules when distributing profit.

Taxes, Fees, and Other Costs to Consider

- Dubai Land Department transfer fee: 4% (buyer normally pays).

- Trustee fee: AED 4,000 (split negotiable).

- Agency commission: 2% of sale price plus VAT (paid by seller).

- Early settlement fee on mortgage: Capped at 1% of outstanding or AED 10,000.

- Capital gains tax (Australia): Payable if you are Australian tax resident; 50% CGT discount applies after 12 months of ownership.

Remember: Dubai still has no personal capital gains tax, but that does not exempt you from Australian CGT if you are resident for tax purposes.

Tips to Maximise ROI When Selling

- Time the FX window: AUD often weakens during northern-hemisphere summer; a 3% currency swing on an AED 3 million sale equals ~AUD 37,000.

- Stage the unit: A modest AED 8,000 furniture refresh can lift selling price by 2–3% in popular short-let districts.

- Pre-clear liabilities: Outstanding chiller or DEWA bills discovered at NOC stage can delay closing and give buyers leverage.

- Offer vacant possession if lease expires within 90 days; ready homes attract a wider pool of end-users who pay a premium.

- Negotiate commission slabs: Some brokers drop to 1.5% on inventory over AED 5 million.

Case snippet

An Australian couple featured in our remote landlord case study secured an extra AUD 61,000 by pairing a forward FX contract with an early-release POA that let them hit the market two weeks faster than competing listings.

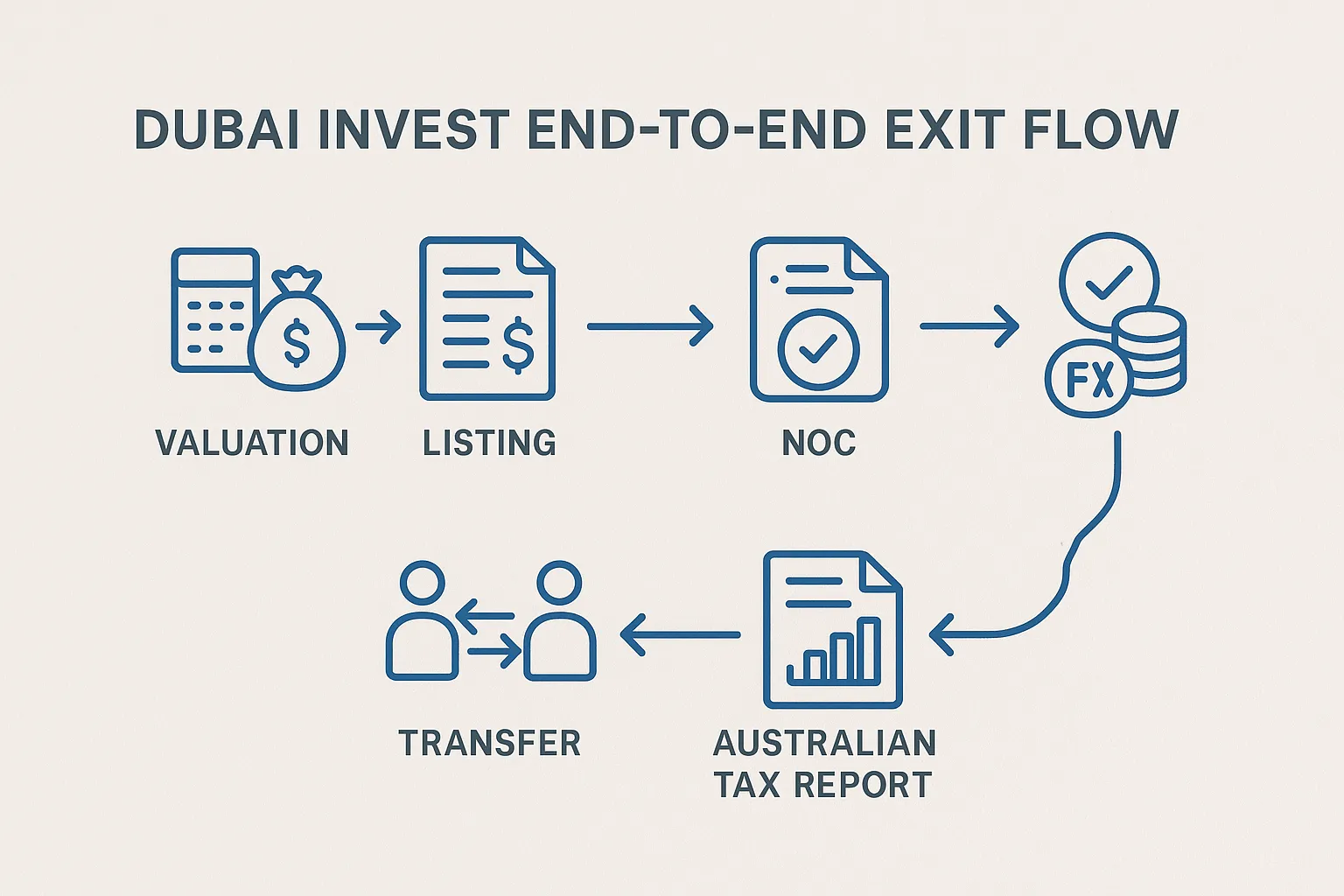

Why Choose DubaiInvest.com.au?

- Local exit specialists: Our Dubai-based brokers and conveyancers coordinate NOC, mortgage clearance, and DLD transfer while you remain in Australia.

- FX and banking corridors: Preferred-rate agreements with two Tier-1 UAE banks and three ASIC-regulated brokers cut average transfer costs by 65%.

- ATO-aligned reporting packs: We bundle sale contracts, cost-base schedule and FX records in a single folder your accountant will love.

- Transparent pricing: Flat advisory fee agreed upfront; no hidden mark-ups on agency commissions or FX spreads.

- End-to-end support: From valuation to POA attestation and tenancy termination, one point of contact manages the entire process.

Conclusion – Ready to Unlock Your Capital?

A structured exit plan turns a complex cross-border sale into a straightforward transaction that preserves both your time and your returns. From obtaining an NOC to wiring fully compliant funds home, each step can be streamlined with the right partner.

Thinking about selling your property in Dubai? Book a complimentary 30-minute strategy call with our property advisory team and discover how Dubai Invest can maximise your net proceeds while you focus on your next investment. Schedule your call today.