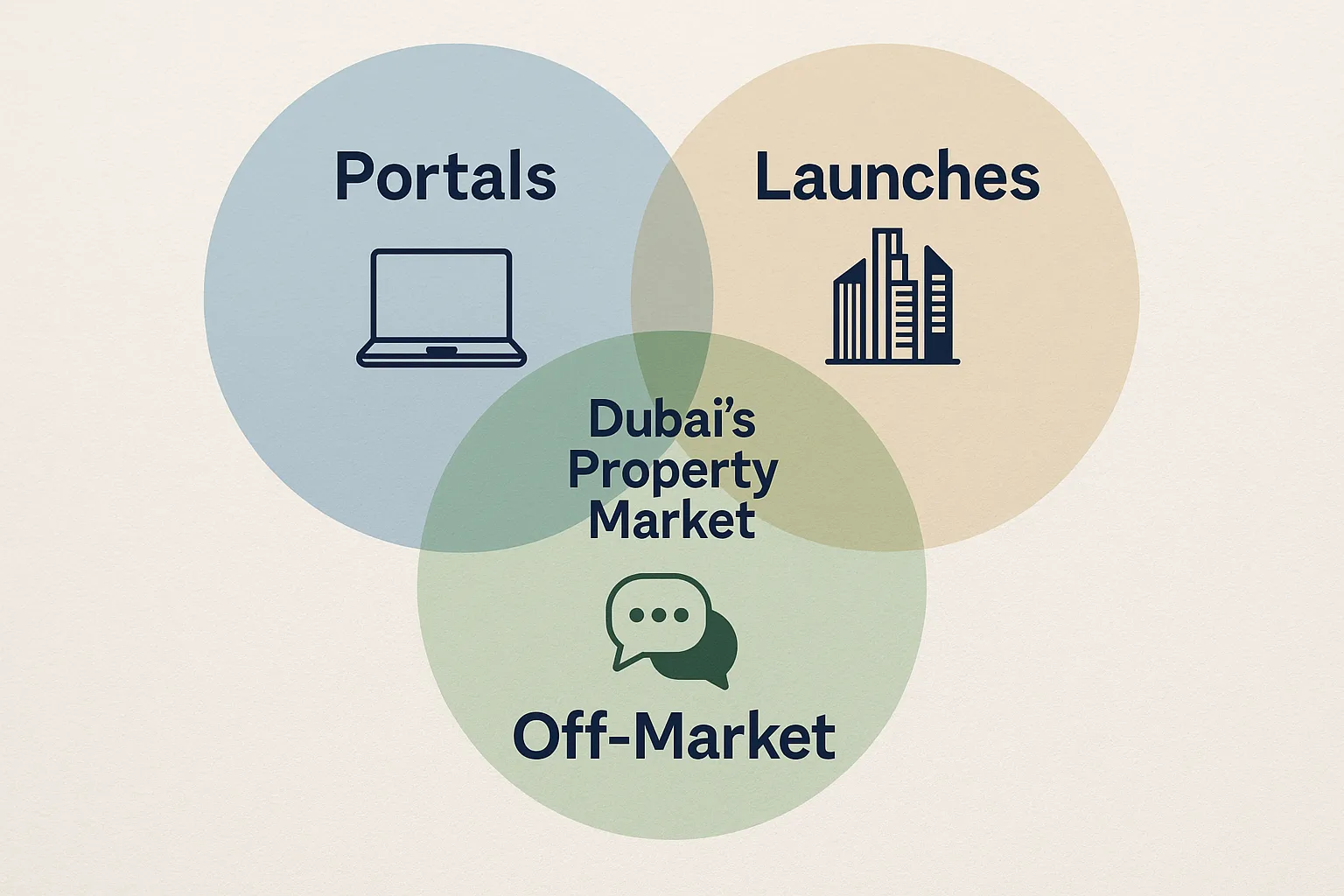

Dubai’s residential and commercial property markets keep defying global headwinds, posting a record AED 430 billion in transactions in 2024 according to the Dubai Land Department. For Australians watching from afar, the numbers confirm a long-term growth story – but they also raise a question: where do you actually find the best deals when you are 11,000 kilometres away?

Below is a practical guide to the most reliable property portals that list on-market stock plus the lesser-known, off-market channels professional investors monitor every week. Bookmark this page; combine several sources, and you will cover roughly 90 percent of the opportunities circulating in Dubai right now.

1. Mainstream listing portals Australians should start with

Property Finder

- Flagship consumer portal with more than 220,000 live listings.

- Detailed filters (neighbourhood, handover date, payment plan frequency, ROI) make it easy to shortlist units remotely.

- Why it matters: Property Finder publishes monthly demand heat-maps and rental yield dashboards that help validate or challenge your strategy.

- Pro tip: Create a saved search to receive instant WhatsApp alerts – timing is everything in Dubai’s fast-moving off-plan segment.

Bayut

- Comparable to Property Finder in traffic, but tends to feature more mid-market and suburban inventory (think JVC, Dubailand, Dubai South).

- Integrates TruCheck™ verification, reducing the duplicate or fake listings that sometimes frustrate overseas buyers.

- Includes live walk-through videos recorded by registered brokers – very handy for sight-unseen decisions.

Houza

- A newer portal backed by a consortium of top agencies (Allsopp & Allsopp, Betterhomes, Berkshire Hathaway, etc.).

- Smaller inventory (≈ 70,000 listings) but higher curation: every property must be exclusive or have valid Form A.

- Strong commercial section – useful if you are exploring warehouse or retail units in free zones like Jebel Ali.

2. Developer launch platforms for off-plan bargains

Most sizeable developers run their own launch calendars before stock appears on portals. Joining the right announcement lists lets you lock units at Phase 1 prices – often 5 to 10 percent below later releases.

- Emaar eServices: The portal for Priority Pass holders. Signing up via an authorised channel gives you 48-hour early access and flexible payment plans (e.g. 70/30 post-handover).

- DAMAC Client Dashboard: Notoriously sells out within minutes. Have your Emirates ID or passport copy on file; move fast when the “Coming Soon” emails drop.

- Sobha Online Sales Events: Popular among yield chasers for its self-contained communities in MBR City. Virtual launch rooms include live chat with sales engineers – ideal for remote due diligence.

3. Specialist portals that punch above their weight

Commercial People UAE

Focus: Office floors, hospitality, staff accommodation. If you are an Australian operator expanding into the UAE – or need an income-generating hotel apartment – this niche site offers direct landlord listings rarely cross-posted elsewhere.

Luxury Property

Inventory is capped at about 5,000 villas and penthouses. Think Palm Jumeirah, Emirates Hills, Jumeirah Bay. Each listing is accompanied by a floor-plan scan and a 360-degree Matterport tour, making remote assessment credible.

Bayut Off-Plan Centre

Technically a sub-section rather than a stand-alone portal, but the database compiles every master community under construction, complete with construction progress pictures and anticipated service-charge ranges.

4. The off-market ecosystem professionals rely on

Off-market does not mean secret – it means relationships. Here are the channels through which stock changes hands before ever hitting the web.

- WhatsApp broadcast lists run by top-tier brokers

- Groups are capped at 256 members, so spots are coveted.

- Expect one-liner deal blasts such as “Investor unit | Creek Harbour | 04 stack | 2 BR | 1.9 M cash, OP 2.15 M.”

- Etiquette: keep replies private; never hijack the group with your own listings.

- Bank-distressed asset desks

- Emirates NBD, Mashreq and ADCB each maintain a small team disposing of repossessed villas and commercial floors.

- Discounts can reach 25 percent off market value, but you must provide Proof of Funds within 48 hours and close quickly.

- Auction platforms

- The Dubai Courts online auction portal lists foreclosures weekly. Registration requires a refundable deposit (usually 20 percent of the guide price).

- English translations are improving, yet bidding windows are short; teaming with a local representative is recommended.

- Private developer allocation clubs

- Think of them as syndicates pooled by large brokerages where initial blocks of units are reserved for repeat investors.

- Minimum ticket sizes vary (typically AED 3–5 million). Buying wholesale means favourable payment schedules and zero agency commission.

- Exclusive mandates via Dubai Invest’s partner network

- Through our on-ground alliances we receive first-look rights on select towers in Business Bay, Dubai Maritime City and Aljada Sharjah.

- These never appear online and are reserved for verified Australian clients.

- Contact us for the latest term sheet.

5. Evaluating sources: a quick matrix

Whenever you discover a property channel, run it through the following filter:

| Criterion | Listing Portals | Developer Launches | Broker WhatsApp | Bank Desks |

|---|---|---|---|---|

| Transparency | High | Medium | Low (info snippets) | Medium |

| Verification | Regulated | Developer guaranteed | Depends on broker licence | Court-audited |

| Speed needed | Moderate | High | Very high | High |

| Typical discount | Market price | 5-10 percent | 3-8 percent | 10-25 percent |

| Suitability for remote buyers | Excellent | Good | Requires local rep | Requires POA |

Use at least two complementary channels – for example, a big portal for market comps and a broker list for cherry-picking cash deals.

6. Practical tips for staying ahead of the feed

- Set calendar reminders for major developer release days (Emaar on Mondays, DAMAC on Wednesdays, Nakheel on Sundays).

- Use UAE time zones in your alerts; launches often go live at 10 am GST – that is 4 pm in Sydney during daylight saving.

- When subscribing to WhatsApp lists, supply both an Australian and a UAE number (eSIM) so you do not miss image-heavy blasts filtered by Telco spam rules.

- Link your account on portals to a Dubai Invest buyer’s mandate. Verified consultants can book unit holds for up to 24 hours, giving you breathing room to review paperwork.

Frequently Asked Questions (FAQ)

Is it legal for non-residents to purchase freehold property in Dubai?

Yes. Since 2002, designated freehold zones allow full ownership for foreign nationals, including Australians. You can own 100 percent of the title and resell or lease without restriction.

How much should I budget for purchase costs?

Total entry costs average 7–8 percent of the property price: 4 percent DLD transfer fee, 0.25 percent mortgage registration (if financed), brokerage fees (up to 2 percent), plus AED 4,200 trustee fees.

Can I complete the transaction without flying to Dubai?

Absolutely. With a notarised Power of Attorney, Dubai Invest can handle unit reservation, contract signing, and title registration on your behalf.

Which portal shows the most accurate rental yields?

Property Finder’s Data and Insights section aggregates Ejari contracts, making its yield calculator the most reliable for major communities.

How do I access bank foreclosure lists?

Submit a buyer profile and KYC documents to the bank’s asset management department or work through an accredited consultant like Dubai Invest who already holds an NDA.

Next step: secure early access deals with local leverage

Online research will only take you so far. The tightest spreads and quickest capital gains come from relationships built on the ground. Dubai Invest has spent the last decade curating those relationships so you don’t have to.

Ready to receive pre-portal allocations or need help shortlisting properties? Book a complimentary strategy call today and we’ll tailor a sourcing plan around your goals.

Invest smart. Set up seamlessly.