Why every Australian investor should factor service charges into Dubai ROI calculations

Nothing eats into a rental yield faster than a monthly bill you did not see coming. In Dubai’s gleaming residential towers those bills are the strata fees (also called “service charges”). Whether you are eyeing a studio in Business Bay or a penthouse on Palm Jumeirah, understanding how these fees are set, regulated and forecasted is critical before you sign a sales contract.

In this guide we break down the numbers, regulation, and real-world ranges for 2025 so you can model your cash flow with confidence—and avoid post-settlement surprises.

1. Strata fees vs. service charges: are they the same thing?

Dubai Land Department (DLD) uses the umbrella term service charges to describe all amounts an owner must pay toward the upkeep of a jointly owned property. Australian investors will recognise the same concept as strata levies back home. In everyday Dubai English the two expressions are used interchangeably, but technically the annual invoice you receive is split into several sub-funds:

- General Fund – day-to-day operations such as cleaning, landscaping, concierge and security.

- Reserve (or Sinking) Fund – long-term capital items: façade painting, lift replacement, roof waterproofing.

- Master Community Fee – charged by the developer of a large estate (for example Emaar’s Dubai Hills Estate) to maintain roads and communal parks.

- Utilities and cooling – in many high-rises, chilled water for air-conditioning is billed as a separate line by Empower or Tabreed.

The figures you see quoted by sales agents—“AED 20 per square foot” for instance—generally reference only the General Fund, so always verify what the rate actually includes.

2. Who sets the levy and who polices it?

Since the introduction of Dubai’s Strata Law (Law No. 27 of 2007) and its subsequent Executive Regulations, the process is fairly transparent:

- Owners’ Association (OA) prepares an annual budget with the building’s facility manager.

- The budget is submitted to RERA’s Mollak platform for auditing. Mollak benchmarks every line item against market averages.

- Upon approval, Mollak issues the official service charge rate per square foot, visible to the public on its portal.

The OA cannot increase the charge without RERA sign-off, and funds are held in an escrow account monitored by DLD—safeguards many offshore jurisdictions still lack.

External reference: You can search any registered project’s current rate on the Mollak public dashboard (https://dubailand.gov.ae/en/eservices/mollak).

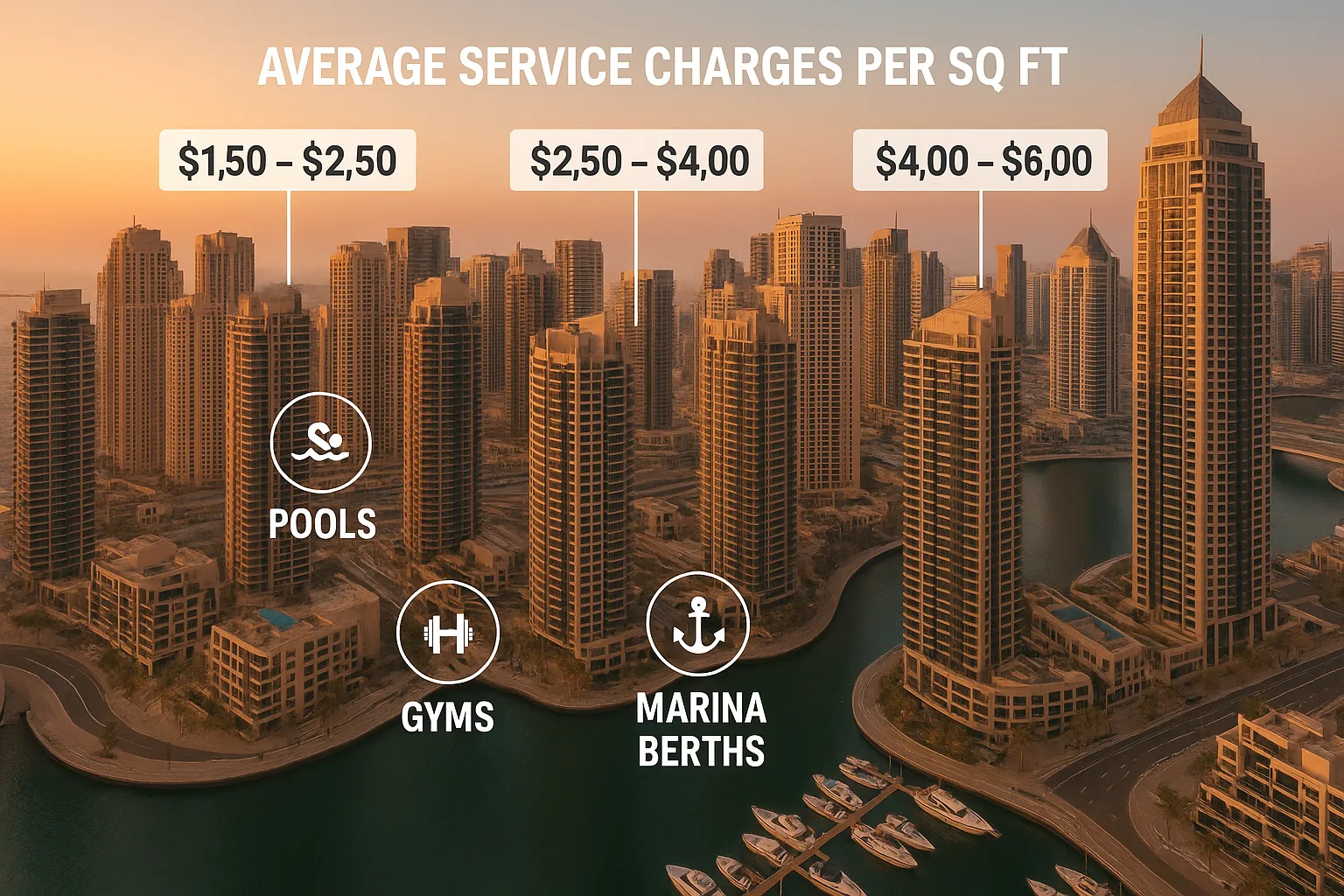

3. How much should you budget in 2025?

Below is an indicative range compiled from the latest Mollak data (Q2 2025) and Dubai Invest’s proprietary portfolio:

| Community & asset type | Typical General Fund rate (AED/sq ft/year) | Reserve Fund loading | Notes |

|---|---|---|---|

| Downtown Dubai high-rise (mid-luxury) | 18 – 23 | +10% | District cooling billed separately |

| Business Bay new-build studio | 16 – 19 | +8% | Some towers bundle chiller |

| Jumeirah Village Circle low-rise | 11 – 15 | +10% | No master community fee |

| Palm Jumeirah Shoreline apartment | 15 – 17 | +7% | Master community ~4 AED/sq ft |

| Dubai Marina premium tower | 20 – 25 | +12% | Valet & beach club access push costs up |

Converting this to Australian dollars (AUD 1 ≈ AED 2.45): a 90 m²* apartment (969 sq ft) in Dubai Marina at AED 25/sq ft equates to AED 24 225 or roughly AUD 9 900 per year before cooling.

*Dubai developers quote net internal area; the OA levy is applied to the “RERA saleable area” which includes balcony and a share of common areas. Expect a multiplier of 1.05–1.15 between the two.

4. What do you actually get for your money?

A well-run building should deliver tangible value for the dirhams collected. Investors should inspect:

- Preventive maintenance schedule – lifts, fire systems, HVAC.

- Staff-to-unit ratio – understaffed towers often show above-average vacancy and tenant turnover.

- Amenities quality – gyms, co-working lounges and kids’ play areas justify higher leases and lower void periods.

- Energy efficiency initiatives – LED retrofits or chiller optimisation can save 10–15% on common-area electricity, cushioning future fee hikes.

Pro tip: Request the OA’s last three AGM minutes. Repeated complaints about water leaks or façade cracks are red flags that Reserve Fund contributions may be insufficient.

5. Hidden extras Australians often overlook

- Chiller deposits – Empower typically requires an AED 2 000 refundable deposit per unit.

- Closing service charge clearance – sellers must obtain a No Objection Certificate (NOC) from the OA, costing AED 500–1 500.

- VAT on air-conditioning – while service charges are zero-rated, district cooling invoices bear 5% VAT.

Knowing these early lets you negotiate the sales contract accordingly, for example by asking the seller to settle any outstanding OA dues pre-transfer.

6. Impact on net rental yield

Let’s compare two hypothetical one-bed purchases in August 2025:

| JVC Low-Rise | Downtown High-Rise | |

|---|---|---|

| Purchase price | AED 800 000 | AED 1 600 000 |

| Gross annual rent | AED 55 000 | AED 95 000 |

| Service charge | AED 12 000 | AED 21 000 |

| Chiller fee (tenant-paid) | n/a | n/a |

| Net yield before mortgage | 5.4% | 4.6% |

Higher service charges do not automatically kill the deal—they often correlate with stronger tenant demand and lower vacancy. What matters is net yield after all running costs versus the mortgage rate you can secure (currently c. 4.99% fixed for non-resident investors according to Emirates NBD, July 2025).

7. Due-diligence checklist before you buy

- Verify the published Mollak rate and expiry date.

- Ask for last year’s audited OA accounts.

- Inspect the building at night: lifted tiles and low lighting suggest cash flow stress.

- Compare Reserve Fund balance against the building’s age (rule of thumb: at least 0.3% of replacement cost per year).

- Review any pending litigation between owners and developer.

Dubai Invest’s buyer advocacy team completes this checklist as part of every acquisition mandate—saving clients an average AED 27 500 in unexpected first-year expenses.

8. How Dubai Invest supports Australian buyers

- Strata audit service – we engage RERA-certified cost consultants to model 10-year levy projections.

- Negotiation leverage – documented maintenance backlogs often justify a 1–2% purchase-price reduction.

- Post-settlement property management – our local team bids insurance, cleaning and FM contracts annually to maintain fee competitiveness.

- Portfolio reporting in AUD – every quarter you receive net-yield statements converted to Australian dollars, simplifying ATO disclosure.

Ready to stress-test a specific tower? Book a complimentary 30-minute call with a Dubai Invest adviser.

Frequently Asked Questions (FAQ)

Are service charges negotiable after I purchase? Only the OA, through its annual budget, can propose a change—and any adjustment requires RERA approval. Individual owners cannot opt out or negotiate a lower rate on their own.

Does the tenant ever pay part of the levy? In standard Ejari leases the landlord pays service charges. However, cooling charges and utility consumption are typically passed on to the tenant.

How often are levies invoiced? OAs issue quarterly invoices, payable within 30 days. Late payment attracts 12% annualised interest under RERA regulations.

What happens if the OA over-collects funds? Surpluses must either reduce the following year’s levy or be transferred to the Reserve Fund; they cannot be distributed as profit.

Is there a cap on how much the OA can increase fees? RERA benchmarking effectively caps increases to market-average costs. In practice, most towers see 3–5% annual rises, broadly in line with UAE inflation.

Ready to model your Dubai investment with real numbers—not hopes? Schedule your free strategy session today at https://dubaiinvest.com.au or meet us in person at the upcoming Grand Business Conference in Sydney on 18 September 2025.

Invest smart. Set up seamlessly.